The Goldilocks Era for iPhone Has Begun

Not too hot. Not too cold. The iPhone is entering a new era that can best be characterized as status quo. The days of huge growth are over, and fundamentals aren't likely to improve significantly from current levels. However, underlying dynamics found with the iPhone business will likely prevent sales and revenue from dropping precipitously in the near term. We are in the iPhone's Goldilocks era.

iPhone Growth Era Over

iPhone sales have plateaued at a 215M units per year pace. As seen in Exhibit 1, Apple reached this sales plateau in mid-2016. The unit sales growth era that had defined iPhone for years is over.

Exhibit 1: iPhone Unit Sales (Trailing Twelve Months)

One issue found with Exhibit 1 is that reported iPhone sales include channel inventory adjustments. This opens the door to Apple management having a greater level of discretion over reported sales, especially in an environment of slowing demand. In an effort to get the most accurate view of iPhone demand, channel inventory adjustments have to be excluded to reveal sales on a sell-through basis (i.e. customer demand).

As seen in Exhibit 2, strong iPhone 6 and 6 Plus sales in late 2014 and early 2015 marked a high point for iPhone unit sales growth on a sell-through basis. After a difficult 2016, growth in sell-through demand has been anemic for the past five quarters. Management's 2Q18 guidance points to only a slight improvement in iPhone sell-through demand. Analysts calling for the "OLED iPhone" to kick off an iPhone megaupgrade cycle in 2018 - something I've been skeptical about from the beginning given the number of growth headwinds found in the iPhone business - have given up on the thesis.

Exhibit 2: iPhone Unit Sales Growth (Sell-Through Basis)

Red Flags

The lack of iPhone unit sales growth is not surprising. In May 2016, I published "iPhone Warning Signs" and the conclusion that "the iPhone growth story is breaking apart and management does not seem to be in control of the situation." Over the past two years, this is exactly what has happened as the four iPhone growth warnings signs highlighted in my article have fully materialized.

- Mobile carrier expansion is complete. Apple no longer has a sales tailwind from bringing iPhone to new carriers around the world.

- India isn't the next China. Any expectation of India becoming an iPhone sales growth engine in the near term is misplaced.

- Smartphone saturation. The era of iPhone sales growth coming from people buying their first smartphone has come to an end.

- Running out of Android switchers. There are only so many premium Android users in a position to switch to iPhone.

Two additional red flags have now appeared:

- Slowing iPhone upgrade rate. iPhone users are holding on to their devices for longer before upgrading. This trend has been unfolding for years, but the impact on iPhone sales is only now being felt.

- Overserving users. One reason iPhone users are holding on to their devices for longer is that their needs are being met with older models and less capable features. While new iPhones are still intriguing and enticing to a majority of iPhone users, a growing percentage of the iPhone installed base is content with their current device.

Instead of there being one particular reason or cause for the lack of iPhone unit sales growth, the six preceding factors have come together to create a much less friendly growth environment.

The Sky Isn't Falling

Given the presence of so many iPhone sales growth headwinds, it is logical to assume that iPhone sales will decline, potentially substantially, from current levels. In such a hypothetical situation, iPhone sales could even track similar to iPad sales which are now trending at 40% below peak levels. However, such a scenario isn't likely in the near term given the unique fundamentals underlying the iPhone business. A closer look at the dynamic between the two main iPhone sales drivers show a more resilient iPhone business.

There are two iPhone sales drivers:

- New iPhone users (a.k.a. switchers). This group includes consumers buying their first iPhone from Apple or a third-party retailer. Once someone buys an iPhone from Apple or a third-party retailer, that person becomes part of the iPhone installed base.

- Existing iPhone users (a.k.a. upgraders). This group includes current iPhone owners who purchase another iPhone from Apple or a third-party retailer.

Over the past six years, Apple has seen very strong iPhone sales to new users. This has helped Apple grow the iPhone installed base from 100M people in 2011 to more than 700M in 2018. These new users have come from various sources over the years. In the beginning, feature phone users drove iPhone installed base growth. Eventually, Blackberry users became a growth driver. Today, former Android users and people using preowned or hand-me-down iPhones are driving Apple's iPhone installed base growth.

As seen in Exhibit 3, I estimate Apple grew the iPhone installed base by more than 100 million people in 2017. While adding 100 million customers to the iPhone installed base is no small feat, my estimate reflects Apple's first year-over-year decline in the number of new users entering the installed base. The iPhone sales growth headwinds mentioned above are starting to take their toll. It is logical to assume iPhone sales to new users will continue to decline as time goes on.

Exhibit 3: iPhone Unit Sales to New Users

One of the largest benefits found with years of strong growth in the iPhone installed base is that Apple now has hundreds of million of users in a position to upgrade to a new iPhone. Exhibit 4 highlights annual iPhone sales to upgraders. According to my estimate, Apple sold a record number of iPhones to existing users in 2017. This may seem counterintuitive given the slowing iPhone upgrade rate. However, following years of dramatic growth in the iPhone installed base, there are simply more iPhone users in a position to upgrade. The increase in the installed base has more than offset the sales headwind caused by a slowing iPhone upgrade rate. It is logical to assume iPhone sales to upgraders will remain robust as time goes on.

Exhibit 4: iPhone Unit Sales to Upgraders

Combining iPhone sales to new users with sales to upgraders provides a clearer view of the dynamic underlying the iPhone business. The number of iPhones sold to existing users is increasing at approximately the same rate as the number of iPhones sold to new users is declining. This dynamic resulted in Apple reporting roughly flat iPhone sales for the past two years. In essence, the iPhone business is operating at sales equilibrium. It took iPad years to find its sales equilibrium after putting in a sales peak in 2013. Products like iPod and Blackberry never found a sales equilibrium as outside forces reduced their long-term value in the marketplace.

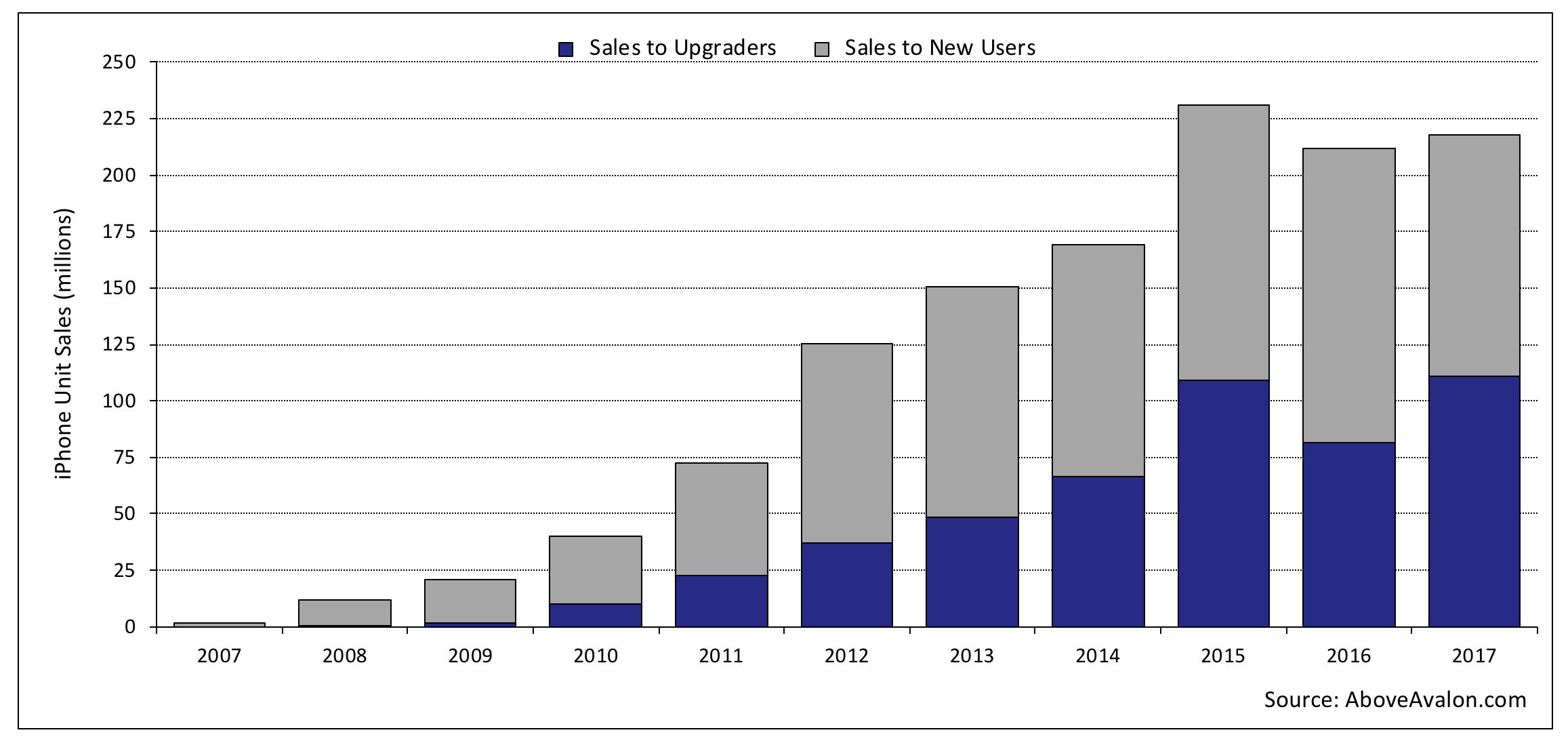

Exhibit 5 highlights the iPhone sales equilibrium dynamic. The blue portion of the bars (iPhone sales to existing users upgrading) made up a larger portion of overall iPhone sales in 2017 while the grey portion (iPhone sales to new users) shrunk.

Exhibit 5: iPhone Unit Sales Mix (New Users vs. Upgraders)

Defining the Goldilocks Era

The iPhone business has entered a new era in which status quo is the new normal. Along with unit sales growth, this dynamic will encompass other iPhone fundamentals such as average selling price (ASP), revenue, and margin trends.

Unit Sales. There is no clear path for Apple to grow iPhone sales substantially from current levels. While Apple may still report quarterly iPhone unit sales growth from time to time, especially if year-over-year compares are favorable, the growth would not represent some kind of step increase in sales.

As long as Apple is bringing in new users, a scenario that is likely to continue for at least the next few years, the iPhone installed base will continue to expand. This expansion will help offset some of the pressure from a slowing upgrade rate. A good rule of thumb is that annual iPhone sales will remain around 215M units, give or take 10 percent, for the next two to three years.

Once new user trends slow to the point of Apple barely bringing in any new users, all bets are off in terms of annual iPhone sales. From a unit sales perspective, the lack of new users will likely mark the top for iPhone sales given an upgrade cycle that continues to elongate. Apple likely has a few years before reaching this point.

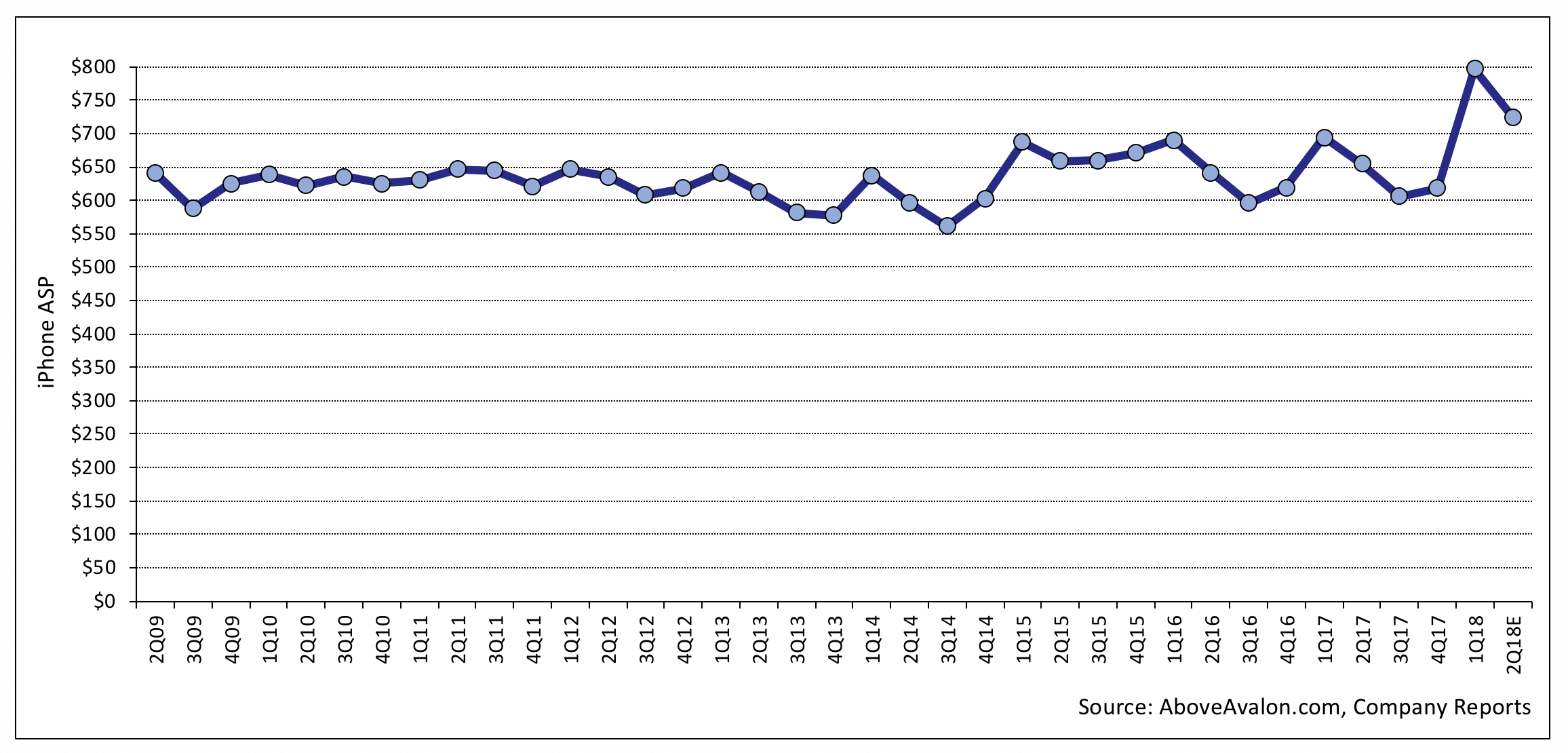

ASP. Similar to iPhone sales growth, iPhone ASP will likely follow this Goldilocks path of not being too hot or cold, but rather following a status quo. As seen in Exhibit 6, after years of remarkable consistency, iPhone ASP hit $796 in 1Q18. Not only was this a record high for iPhone ASP, but the $178 sequential jump in ASP was also a record. The strong results were driven by a perfect storm of the higher-priced iPhone 8 and 8 Plus as well having the iPhone X launch take place in 1Q18.

Management commentary points to iPhone ASP falling in 2Q18. ASP will then decline further as we move away from the iPhone 8, 8 Plus, and X launches.

Apple can only push so far with iPhone pricing in the near term before demand trails off due to accessibility concerns. While many thought that threshold was $999 for an iPhone, in reality it's probably closer to $1,500. In addition, Apple will likely continue to get aggressive at the low end of the iPhone pricing spectrum. Accordingly, a reversion to the ASP mean of $650 is likely. The addition of a higher-priced iPhone X with a larger screen should keep iPhone ASP from falling too far below $650 in the near term.

Exhibit 6: iPhone Average Selling Price

Revenue. Apple saw robust iPhone revenue growth in 1Q18 due to the dramatic jump in iPhone ASP. Going forward, an ASP reverting back to the mean, combined with modest iPhone unit sales growth, will make it difficult for Apple to maintain robust iPhone revenue growth.

Margins. Apple doesn't disclose iPhone margins. However, given the company's stable overall gross margin, there is no reason to believe iPhone margins have deteriorated significantly in recent years. While Services revenue growth has certainly contributed to Apple's stable overall gross margin, much of that positive impact has likely been offset by weaker wearable and iPad margins.

One reason iPhone margins won't likely change much in the near term is Apple's broader iPhone strategy of using higher-priced, high-margin SKUs to offset margin pressure from lower-priced SKUs.

Implications

There are two major implications from the iPhone business entering a Goldilocks era:

- Time. A relatively stable iPhone business buys Apple management much needed time to come up with the next big thing(s). It's been a little more than three years since Apple unveiled Apple Watch, the company's most recent major new product category. New products like Apple Pencil, AirPods, and HomePod are accessories meant to work with Apple's major product categories. It's not realistic to expect Apple to launch new major product categories every three or four years. Instead, pressure for Apple to unveil a new product category will likely begin to grow in 2019 or 2020, five to six years after the Apple Watch was unveiled.

- Money. The iPhone is kicking off approximately $60 billion of gross profit per year. Assuming iPhone fundamentals remain relatively unchanged from current levels, Apple stands to earn close to $200 billion of gross profit from iPhone over the next three years. This is enough cash to support Apple's organic growth, R&D, M&A, and still leave funds to handle the capital return program.

Risks and Wildcards

In the mid-2000s, there was a school of thought that viewed the U.S as having a Goldilocks economy. Instead of strong growth, which would lead to inflation, or weak growth, which would lead to a recession, the economy was following a path somewhere in the middle. As it turned out, an asset bubble was forming in housing during this period. The bubble burst in 2007. A massive recession ensued, made much worse by toxic financial instruments based on an inflated asset.

Is there a variable that may do the same to the iPhone business? What may be developing or building in the background that has the potential to appear suddenly and quickly unravel the iPhone business overnight?

A few of the more popular items positioned as iPhone risks include:

- Voice. The expansion of rudimentary digital voice assistants into new platforms where data is increasingly transferred via voice and value moves away from apps and touch screens.

- Post Device Era. All-powerful cloud services eventually reduce the value found with hardware.

- China. The iPhone business can experience a sizable contraction overnight due to new policies enacted in China targeting Apple.

- Lack of Innovation. Mediocre features that are on par with competitors can lead to longer upgrade cycles, lower margins, and fewer sales.

- New Product(s). A new kind of product reduces the value found with iPhone.

Out of those five items, China regulatory issues represent the only item capable of impacting a decent portion of iPhone sales overnight. China is responsible for approximately 30% of iPhone sales. The other risks don't pose as much of a near-term concern for the iPhone business.

The largest wildcard that will jeopardize the iPhone business over the long run is a new kind of screen that is able to grab our time and attention away from iPhone. (I don't think voice by itself will be the answer.) This screen won't replace the iPhone, just as the iPhone didn't replace a laptop or desktop. Instead, this screen will initially appeal to those who felt overserved by iPhone. Eventually, this screen will begin to handle an increasing number of new tasks and workflows, some of which were never given to iPhone. Apple Watch and a pair of augmented reality (AR) glasses are best positioned to be those screens.

The initial versions of AR glasses for the mass market will probably be more like head-up displays positioned as smartphone accessories. This leads me to think that it will be difficult for new products to unravel the iPhone business overnight. The iPhone is simply too multi-functional and multi-purpose. The artificial sense of safety found with such a statement does not escape me. The moment when it seems like there is nothing that can impact a business or product is usually the time when safety needs to be thrown out the window.

Big Picture

The iPhone's Goldilocks era is all about stable fundamentals for the next two to three years. During this period, Apple will continue to experiment with higher-priced and more capable SKUs at the high end while making iPhone more accessible with lower pricing at the low-end.

As for what comes after the Goldilocks era, a good argument can be made that iPhone's future is one of a powerful AR navigator. In this environment, Apple Watch and Apple Glasses handle much of the low-hanging fruit in terms of mobile tasks and workflows while iPhone is a more powerful computer targeting increasingly niche applications. This would lead to less robust iPhone unit sales but improved ASP and margin trends.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates. To sign up, visit the subscription page.