Apple Just Held Its Strongest September Event in Years

Hello everyone. Today’s update will go over my initial impressions from Apple’s “It’s Glowtime” event. The discussion will have more in the way of big picture takeaways. We will get to the specifics, including my thoughts on the features, on Wednesday and possibly Thursday.

Let’s jump right in.

Apple Just Held Its Strongest September Event in Years

Apple’s “It’s Glowtime” event was jam-packed with HW updates.

The Apple Watch Series 10 marked one of the more significant year-over-year improvements for a flagship Apple Watch in years. We will likely see a bump up in the non-Ultra to Ultra sales ratio.

All four iPhone flagships contained notable upgrades including A18 (for non-Pro models) / A18 Pro (for Pro models), Camera Control (touch-capacitive area with sensors and haptic motors), and improved battery life across the line.

The entire AirPods line saw updates for the first time since the line expanded to three models, with AirPods receiving a H2 chip along with fit and comfort enhancements, AirPods Pro becoming a clinical-grade Hearing Aid, and AirPods Max receiving its first change in its four-year life (USB-C and new colors).

Apple sneaked in a non-HW Apple Intelligence feature, Visual Intelligence, tied into Camera Control. Visual Intelligence provides iPhone users context for their surroundings.

After looking back at prior September events, it’s fair to say yesterday’s event was the strongest Apple September event since at least 2017 (iPhone X unveiling). That is not meant to belittle or

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Above Avalon Membership

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

Thoughts on Apple Product Pricing, My iPhone and Apple Watch Sales Mix Estimates, U.S. Carriers Improve iPhone Promotions

In today’s update, we go over a few topics related to the new Apple Watches and iPhones. The discussion begins with Neil’s thoughts on new Apple Watch and iPhone pricing. We then turn to Neil’s estimates for unit sales mix by Apple Watch and iPhone model. The update concludes with U.S. carriers improving their iPhone promotions.

Hello everyone. Welcome to a new week. Let’s jump right in.

Thoughts on Apple Product Pricing

At last week's product event, no major changes to Apple’s product pricing strategy were announced. There were more than a few rumors suggesting iPhone Pro pricing was going up against the board. That did not occur. Generally, Apple pricing rumors should be discounted as Apple is able to keep pricing information under wraps.

Here is entry-level pricing for each Apple Watch collection:

Apple Watch Series SE: $249 (GPS) – did not receive any updates last week

Apple Watch Series 9: $399 (GPS)

Apple Watch Ultra 2: $799 (GPS + Cellular)

We will talk more about my sales mix expectations by Apple Watch model shortly. For now, it is important to point out how Apple is sticking with

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Reading Between the Lines of Apple’s 3Q23 Earnings Q&A With Analysts

Hello everyone.

In today’s update, we will focus on Apple’s 3Q23 earnings Q&A session with analysts. After recapping each question-and-answer exchange that occurred on the call between Apple and sell-side analysts, we will go over my thoughts / response to the exchange. Let’s go beyond what was talked about on the call.

NOTE: The following earnings call questions (“Q (Sell-Side Firm)”) and answers (“Cook” or “Luca”) have been cut, summarized, paraphrased, and rearranged for clarity. To read the full question and answer exchanges, Seeking Alpha offers a written transcript here.

Reading Between the Lines of Apple’s 3Q23 Earnings Q&A With Analysts

Consumer Behavior

Q (Morgan Stanley): How is the consumer behaving today versus 90 days ago? Are there geographical differences?

Cook: Emerging markets was a strength. China saw acceleration. Europe saw a record for the June quarter. There are “some really good signs in most places in the world.” The smartphone market remains challenging in the U.S.

My response: The going theory for why the U.S. has been the outlier in terms of iPhone weakness is that economic anxiety (higher inflation and rates) combined with consumer behavior shifts (budget shift to services, leisure, eating out, and travel) have strained the appetite for consumer electronics. It also should be pointed out that the U.S. has one of, if not the highest, iPhone sales share in the world. There are fewer people in a position to switch to iPhone.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple 3Q23: By the Numbers, The Most Impressive Apple Number, About That Weak iPad Number

Today's special Friday edition of the Daily Update will be focused on reviewing Apple’s earnings. The idea is to keep things broad and look at the big picture takeaways. We also examine how Apple’s results compared to Neil’s expectations. The discussion will continue next week.

Hello everyone. We will begin reviewing Apple's FY3Q23 results. Let's jump right in.

Apple 3Q23: By the Numbers

The themes that guided the past few quarters for Apple were present in the company’s FY3Q23 results. Emerging markets strength is being offset by a slowdown in iPhone upgrading in the U.S. Meanwhile, solid Services revenue generation is being offset by weak Mac and iPad results. The result is mostly flat revenue growth with FX continuing to serve as a growth headwind (Apple’s FX hedging program creates a lag in receiving any weaker dollar benefit).

This past Monday, we went over three factors that point to FY2024 being a better one for Apple financially. Following Apple’s FY3Q23 results and earnings call, there has been no change in my thinking.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Setting the Stage for Apple’s FY3Q23 Earnings

Apple reports FY3Q23 earnings (results from April to June) later this week. Today’s update includes Neil’s big picture thoughts heading into Apple’s earnings.

Happy Monday.

Apple reports earnings on Thursday. For those of you who may be new to Above Avalon membership, I wanted to quickly discuss the typical game plan for Apple earnings coverage.

Prior to Apple’s earnings release, we go over my expectations for what will be announced. These expectations cover both qualitative and quantitative items. Expectations are important given the role they play in adding context to a company’s results. My Apple earnings previews typically extend across two, possibly three, updates.

Once Apple reports earnings, we will then go over everything there is to say about the release, the earnings conference call, and even the 10-Q or 10-K. By the end of the process, we have a comprehensive overview of both Apple’s results for the prior three months and analysis of guidance for the current quarter.

Today, we will kick off my Apple earnings preview with an overview of the setup heading into Thursday’s release.

Setting the Stage for Apple’s FY3Q23 Earnings

Over the next few months, the setup is becoming more positive for Apple’s financial results. My expectation is that when Apple reports earnings on Thursday, we will begin to see and hear the early signs of this improvement. Apple’s guidance for FY4Q23 could still point to the business facing macro pressures, but that would then clear the deck in a way for an all-around better FY2024.

There are three factors behind this “improvement on the horizon” theme:

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

My Apple 2Q23 Estimates, Expectations for Apple's Capital Management Changes, My Revised Apple Earnings Model (Daily Update)

Apple reports FY2Q23 earnings on Thursday. Today’s update contains the second half of Neil’s earnings preview. The first half is available here. The update begins with Neil’s granular financial estimates. The discussion includes qualitative explanations for each of Apple’s product categories. We then look at Neil’s expectations for what Apple will announce regarding its cash dividend and share repurchase authorization. We conclude with Neil’s updated Apple earnings model and how the model has changed over the past three months. Access to Neil’s Apple earnings model is a benefit associated with Above Avalon membership at no additional cost.

Hello everyone. Similar to previous quarters, with Apple releasing earnings tomorrow, Thursday’s update will be pushed out a day so that there is a special edition Friday version of the daily update.

Let’s jump into the second half of my earnings preview.

My Apple 2Q23 Estimates

Here are my granular estimates for Apple’s 2Q23:

Revenue: $95.7B (consensus: $93.0B)

Overall gross margin: 44.6% (guidance: 43.5% to 44.5%)

Gross margin (HW): 37.5%

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Consumers Spending Less on Electronics, Impact on Apple, Swiss Watch Sales Data for 2022 (Daily Update)

Hello everyone. Happy Wednesday. It feels good to get back into the swing of things after a little time off.

We kick off today’s update with Neil’s thoughts on Walmart and Home Depot pointing to major shifts in how consumers are spending their money. We look specifically at the impact the trend will have on Apple. The update concludes with an examination of Swiss watch industry sales for 2022 and why Neil thinks Apple Watch continues to impact the Swiss.

Consumers Spending Less on Electronics

Earlier today, a WSJ article with the headline “Walmart, Home Depot Give Cautious Outlook as Shoppers Spend More on Basics,” jumped out at me. Here’s Sarah Nassauer:

“Consumers are spending more on food and less on electronics, apparel and home improvements as inflation and changing habits zap demand for many goods, two of the country’s largest retailers reported Tuesday.

Walmart Inc. and Home Depot Inc. have enjoyed robust sales for much of the past two years as people looked for bargains or fixed up their homes. Now more of shoppers’ budgets are going to higher-priced groceries and travel, executives said.

For Home Depot, which primarily sells home-improvement goods, that dynamic meant flat sales in the most recent quarter. For Walmart, which relies on groceries for the majority of its sales, it meant larger-than-expected sales growth. But executives from both companies said consumers’ spending habits pressured profits and they gave muted outlooks for the rest of the year amid economic uncertainty.

‘Customers are still spending money,’ said Walmart Chief Executive Doug McMillon. ‘It’s obviously not as clear to us what the back half of the year looks like.’”

The following slide from Walmart’s earnings release serves as a helpful summary of what the largest retailer is seeing:

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Previewing Apple’s 4Q22 Earnings, My Apple 4Q22 Estimates, Apple Raises Apple Music and Apple TV+ Pricing (Daily Update)

Happy Tuesday.

We will go over my updated Apple earnings model tomorrow. It's not quite ready for publication. As a reminder, with Apple reporting earnings on Thursday, here is the daily update schedule for the rest of the week:

Wednesday: Regular update

Thursday: No update

Friday: Special Friday update dedicated to reviewing Apple earnings

Previewing Apple’s 4Q22 Earnings

My expectation is for Apple to report OK results on Thursday. While FX, inflation, and ongoing supply chain issues will negatively impact numbers, Apple should be able to comfortably exceed the all-time FY4Q revenue record ($83B is the current record).

FY4Q presents a few challenges for Apple financial modeling and earnings analysis as results reflect demand and supply trends 1) leading up to the critical September product launches and 2) a portion of the product launches themselves. For Apple, those two periods can end up representing distinct demand environments.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Measuring Apple Watch’s Sales Potential, Apple Contemplating Apple TV Ad Play, ByteDance Planning Spotify Battle (Daily Update)

Hello everyone. We will kick off today's update with one follow-up to yesterday's Apple Watch discussion.

Measuring Apple Watch’s Sales Potential

Yesterday, we talked about Apple Watch sales and adoption trends up to the end of September 2022.

As for looking forward, there is no near-term ceiling as to the percent of iPhone users who will embrace Apple Watch. The Apple Watch ushered in a paradigm shift in computing, even if consensus still isn't willing to acknowledge the shift. Since wearables are capable of making technology more personal, there will be a natural evolution involving consumers gradually finding spots in their lives for wearables.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

4Q22 Apple Watch Installed Base, Apple Watch Adoption Figures (Daily Update)

Hello everyone. Happy Wednesday.

One quick follow-up to yesterday’s update regarding the Pixel 7 and 7 Pro.

When it comes to assessing Google’s odds of finding traction with the Pixel 7 and 7 Pro, the following screenshot of AT&T's website highlights a big obstacle:

AT&T's bet on Apple is nothing new. Instead, the mobile carriers have been placing even bigger bets on iPhone and Apple in recent years. The logic is straightforward. Consumers want iPhones and carriers don't want customers to look elsewhere for the best iPhone deals. The lack of carrier support/promotion leaves Google appealing to die-hard Android users who have become disenchanted with Samsung hardware. At least in the U.S., that's not a huge market.

4Q22 Apple Watch Installed Base

It's been a year since we went over my estimates for the Apple Watch installed base. Given different definitions of user bases and installed bases, my definition of the Apple Watch installed base is the number of people wearing an Apple Watch on any given day.

Unlike the iPad and Mac, we don’t have to worry about shared settings where one Apple Watch is shared among a number of people. We also don’t have to be concerned with the very small number of people who wear or use multiple Apple Watches.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

John Mayer vs. Apple Watch Ultra, Apple Watch Ultra’s Appeal, Apple and Oprah End TV+ Deal (Daily Update)

Hello everyone. We will start today’s update in Apple Watch land. Let’s jump right in.

John Mayer vs. Apple Watch Ultra

John Mayer is known by most as a musician. However, in the mechanical watch world, he is considered a trendsetter / influencer.

“Anyone who follows John Mayer on Instagram is accustomed to seeing watches on his feed. Typically, they are very nice, very exclusive watches: Rolex ‘Rainbow’ Daytonas, the new Audemars Piguet Royal Oak with gems set in a design that mimics an equalizer, one of Patek Philippe’s impossible-to-find sport watches. But he shared an unexpected message on Wednesday.

‘Did Apple just make….a tactical watch?’ he wrote. ‘Been wearing the Apple Watch Ultra for a week…’—build that suspense, John!—‘and it’s great.’ This news probably registered as a sizable earthquake in Geneva. Because Mayer is not just any well-heeled and avid collector, he is likely the watch world’s most prominent tastemaker. When he wears a green-and-gold Rolex Daytona, the value shoots up in price and is now known as ‘the John Mayer.’ Spotting a certain Royal Oak on his wrist can inspire dealers to go out and snap up a couple dozen of that exact piece. Certainly, Mayer’s co-sign won’t have that sort of effect on the Apple Watch, which is already bought up in higher quantities than what the entire Swiss watch industry is moving combined. But given the Apple Watch’s unique place in the watch universe—worn by nearly everyone, but nobody’s idea of collector bait—Mayer’s endorsement is a huge deal."

To be exact, Apple is on track to sell three times as many watches as the Swiss will export in 2022 (my estimate).

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple FY3Q22 Earnings Recap

Two weeks ago, Apple reported a solid FY3Q22 (April to June) given the tough year-over-year compare and considerable FX headwind. In terms of good news, supply chain issues, component shortages, and COVID-related headwinds appear to have bottomed for Apple. When it comes to bad news, some parts of Apple’s business are getting hit by inflation and slowing economic growth more than others.

Here are Apple’s reported 3Q22 results versus my expectations with brief commentary for each item.

Revenue: $83.0 (vs. my $85.9B estimate). Results missed my estimate due to a larger than expected headwind from FX, a larger than expected supply shortage with Mac, and macro issues impacting Wearables, Home, and Accessories.

EPS: $1.20 (vs. my $1.25).

iPhone revenue: $40.7B (vs. my $39.9B). That’s a good iPhone revenue number that doesn’t raise any yellow or red flags to me.

Services revenue: $19.6B (vs. my $20.1B). Results missed primarily on a larger than expected headwind from FX.

Wearables / Home / Accessories revenue: $8.1B (vs. my $9.4B). This was a weak number which Apple attributed to a “cocktail of headwinds.”

Mac revenue: $7.4B (vs. my $8.9B). Apple experienced major issues with supply as the Mac was the product category impacted the most by COVID lockdowns closing factories in China.

iPad revenue: $7.2B (vs. my $7.6B). Apple experienced ongoing issues with iPad supply.

Overall gross margin: 43.3% (vs. my 43.3%)

Services gross margin: 71.5% (vs. my 72.0%)

Products (HW) gross margin: 34.5% (vs. my 34.5%)

Breaking down the $2.9B revenue miss to my estimate, there were two primary drivers:

$1.5B revenue miss due to Mac supply not being as good as thought.

$1.3B revenue miss due to weaker Wearables, Home, and Accessories.

Even though Apple missed my (elevated) expectations, the company reported a 3Q22 beat to consensus as revenue came in about $2B stronger than sell-side analysts were expecting. The beat was due to stronger iPhone revenue as most analysts were expecting something more like $36B to $38B of iPhone revenue (vs. the $40.7B reported figure). EPS came in $0.04 above consensus as Apple’s margins came in slightly better than consensus thought as well.

An Above Avalon membership is required to continue reading this article. Members can read the full article here.

The full article includes the following sections:

Apple’s 3Q22: The Key Numbers

iPhone Sales Resiliency

Apple Ecosystem Growth Slows

Reading Between the Lines of Apple’s 3Q22 Earnings Q&A With Analysts

Notes From Apple’s 3Q22 10-Q

Tracking Apple’s Paid Subscriptions

Apple's Share Buyback Update

My Revised Apple Financial Estimates

An audio version of the article is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

Above Avalon Membership

Become a member by using the following signup forms (starting at $20 per month or $200 per year).

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Above Avalon Year in Review (2021)

Heading into 2021, Apple had just gone through one of the more tumultuous years in its existence. As discussed in last year’s Year in Review, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. Expectations that 2021 would be much smoother turned out to be optimistic. While society did largely open up halfway through the year, which allowed Apple’s retail apparatus to return to normal operations, Apple continued to face once-in-a-few-decades challenges when it came to the supply chain, product manufacturing, and navigating its 154,000 employees through a pandemic.

According to my estimate, Apple experienced $10 billion of unmet demand in 2021 as a result of supply chain issues. This total is on top of lingering demand issues associated with wearables that arose from the pandemic.

Despite the challenges, 2021 was a record year for Apple on a number of business fronts:

Apple sold 260M+ iPhones - a record high for a 12-month period.

Apple sold 25M Macs - a record high for a 12-month period.

The Apple Watch installed base surpassed 100 million people.

Articles

In 2021, I published 10 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s ecosystem continues to gain strength and is ready for the next major product category launch (a mixed reality headset).

Here are a few of my favorite articles published in 2021 (in no particular order):

Apple Has a Decade-Long Lead in Wearables. AssistiveTouch allows one to control an Apple Watch without actually touching the device. A series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The technology is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years, but more like a decade.

Apple Won the Share Buyback Debate. I receive many questions about Apple from Above Avalon readers, listeners, and members. In previous years, one topic has been far ahead of any other as a source of questions. Everyone wanted to know about Apple’s share buyback program. Something interesting happened in 2020. I received far fewer questions about Apple’s share buyback program. To be precise, I didn’t receive an incoming question about buyback in nine months - from when the stock market put in a bottom in April 2020 to the start of 2021. What explains such a dramatic change? The Apple share buyback debate ended, and Apple was declared the winner.

Apple’s Extremely Quiet Year for M&A. While going through Apple’s 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In 2021, Apple spent just $33 million on business acquisitions (M&A). That’s a record low for Apple with Tim Cook as CEO. It’s a number that deserves further investigation as Apple’s M&A strategy and philosophy play a big role in how Apple was able to get to where it is today.

The five most popular Above Avalon articles in 2021, as measured by page views, were:

Podcast Episodes

There were 11 episodes of the Above Avalon podcast recorded and published in 2021, totaling 4.5 hours. The podcast episodes that correspond to my favorite articles are found below:

Charts and Exhibits

The following charts and exhibits found in Above Avalon articles published in 2021 were among my favorites.

Apple Wearables Unit Sales (2017 to 2021) - from Apple Has a Decade-Long Lead in Wearables

According to my estimate, Apple is on track to sell 105 million wearable devices in 2021. That total represents 40% of the number of iPhones sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Percentage of Apple Revenue Through Direct Distribution Channel - from The Future of Apple Retail

The percentage of sales going through Apple’s direct distribution has gradually increased in recent years. The increase in sales percentage has likely been boosted by services revenue, more sales going through Apple’s website, and more iPhone upgrading taking place through Apple.

Note: Direct distribution channel includes Apple’s website, Apple stores, and direct sales force.

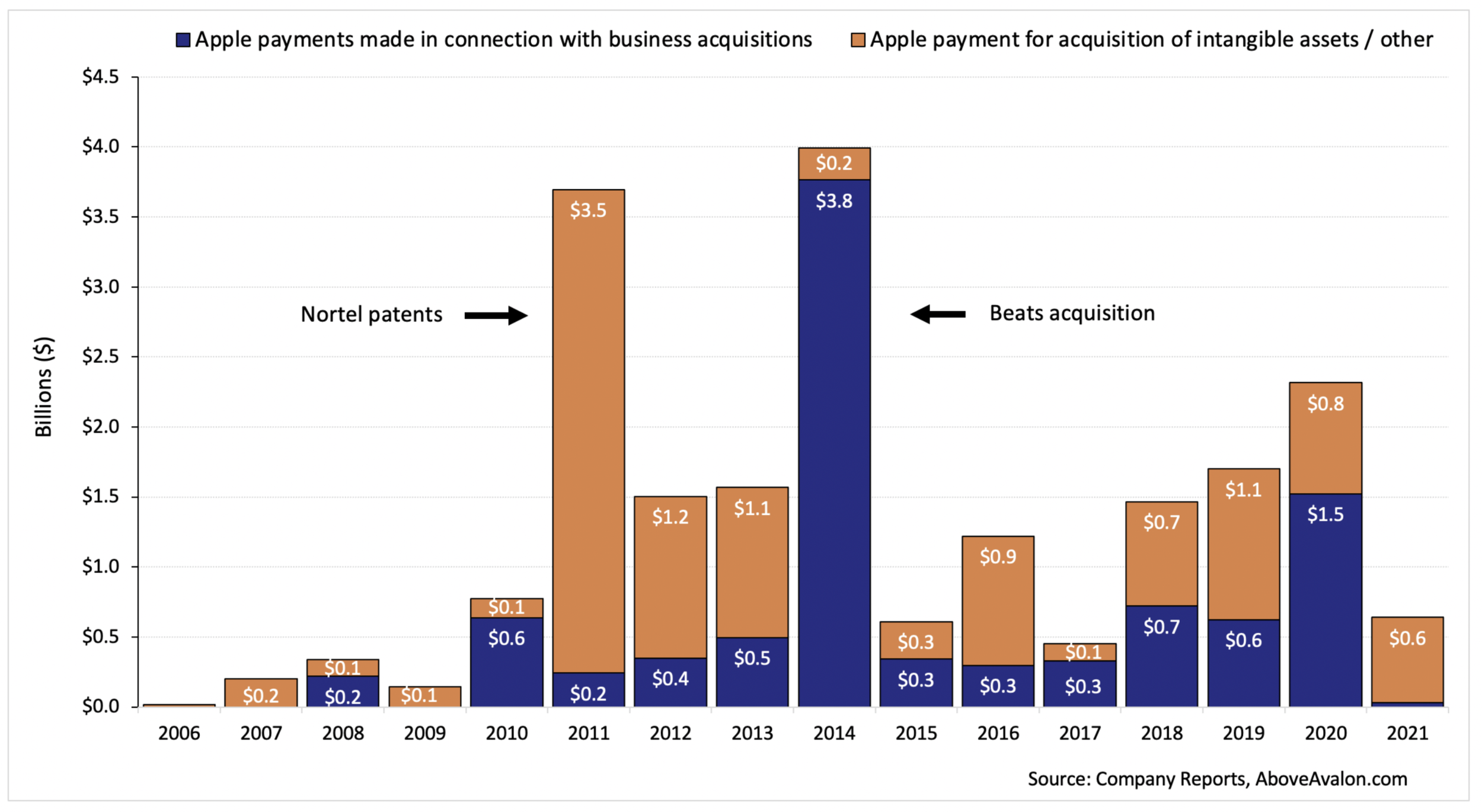

Apple M&A (Cash Payments) - from Apple’s Extremely Quiet Year for M&A

Since 2006, Apple has spent $20.6 billion on M&A with about half of the total tied to “business acquisitions.” The median is $1 billion per year. However, in 2021, Apple spent just $33 million on business acquisitions. That is the lowest amount since 2009 when Steve Jobs was still Apple CEO.

Daily Updates

In 2021, I published 182 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 182 updates are equivalent to five books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Project Titan Moving Forward

Along with mixed reality and AR, transportation is one of the largest areas of opportunity when thinking of future Apple products and services. The year turned out to be the busiest one yet when it came to Project Titan news as Apple began to seek supply chain and manufacturing partners.

Hyundai Confirms Talks With Apple, Apple Considering Car Factory in Georgia, Making Sense of Apple and Hyundai News (Jan 12, 2021)

Apple Car and the Last Mile, Revisiting an Apple Campus Shuttle Service, Thursday Q&A (Feb 4, 2021)

Apple’s Kevin Lynch Joins Project Titan, Apple Car Implications, Apple Watch Implications (Jul 19, 2021)

Doug Field Leaves Apple for Ford, Project Titan’s Trajectory and Leadership, Silicon Valley vs. Detroit (Sep 8, 2021)

Kevin Lynch Tapped to Lead Project Titan, Disillusionment in the Auto Space Is Setting In, Ted Lasso Wins Big at the Emmys (Sep 20, 2021)

Changes in Paid Video Streaming Land

Given the rush of new players into the paid video streaming space in 2020, there was quite a bit of movement in 2021. AT&T’s decision to spin off WarnerMedia was an industry-shaking event. As the months went on, it became clear that many content distribution services were experiencing something equivalent to a pandemic air pocket as subscriber trends became noisy. Netflix and Roku ran into friction while the true new kid on the block (Apple TV+) regained momentum with new shows and movies coming online in the back half of the year.

AT&T to Spin Off WarnerMedia, HBO Max’s Future, Apple Implications May 17, 2021

WarnerDiscovery and Apple M&A, Ranking Paid Video Streaming Leaders, Netflix Contemplating Move into Gaming May 26, 2021

The App Store’s Day in U.S. Court

The well-publicized Epic Games vs. Apple trial resulted in a resounding legal victory for Apple. It ended up being difficult to grasp just how poor of a job Epic Games did in trying to paint Apple as a monopoly. While the court did order Apple to change its anti-steering provision in the U.S., Apple won a stay by a court of appeals. The outcome with the highest probability is for the anti-steering provision to remain as is which would signal Apple’s very strong legal footing as it pertains to the App Store.

Epic Games vs. Apple, Epic's Arguments Against Apple, Epic’s Motivation Apr 27, 2021

Thoughts on the Epic Games vs. Apple Ruling Sep 13, 2021

When looking at my daily updates published in 2021, selecting a few favorites out of 196 updates was not easy. The following updates stood out to me (in no particular order):

Warren Buffett’s Annual Letter, Apple Isn’t Buffett’s Token “Tech” Stock, Apple, Buffett, and Buyback. We kick off today’s update with my thoughts on Warren Buffett’s 2020 letter to Berkshire Hathaway shareholders. Berkshire is Apple’s largest individual shareholder. The discussion then turns to why I don’t agree with those claiming Apple is Buffett’s token tech stock. We conclude by looking at share buyback and how the capital return mechanism leads to a wealth transfer event. (Mar 2, 2021)

Peloton Recalls All of Its Treadmills, The At-Home Fitness Revolution Needs a Reset, Apple, Fitness Machines, and Gyms. Today’s update will be focused on the at-home fitness industry. It’s a market that Apple moved deeper into a few months ago with Apple Fitness+. A good argument can be made that at-home fitness impacts other Apple devices as well especially Apple Watch and Apple TV. We kick things off with my thoughts on Peloton recalling all of its treadmills. The discussion then turns to why I think the at-home fitness industry needs a reset. The update concludes with how fitness equipment safety, or the lack thereof, impacts Apple and why I continue to think there will be a role for gyms to play in the future. (May 6, 2021)

Tesla Buys Bitcoin, Apple and Bitcoin, Apple and Crypto Exchanges. Today’s update will be focused on bitcoin. We begin with news of Tesla buying $1.5B of bitcoin. We then turn to my thoughts on whether or not Apple should follow Tesla into bitcoin. The update concludes with a closer look at RBC Capital Market’s suggestion that Apple should move into cryptocurrency exchanges. We go over why I don’t think the firm’s analysis passes the small test. (Feb 10, 2021)

Apple’s Services Journey, A Different Way of Thinking of Apple One, Apple Services Evolution. For the first time in what feels like a long time, the Apple news cycle is taking a breather. This provides us with an opportunity to pursue some original topics. We kick off today’s update with my thoughts on the narrative surrounding Apple’s Services business. Things are starting to change. The discussion then turns to how I think about Apple’s Apple One bundle and how reframing Apple One leads to some interesting questions and ideas as it pertains to the competition. The update concludes with my thoughts on the future factors determining where Apple Services are headed. (Jul 13, 2021)

Niantic CEO Pours Cold Water on the Metaverse, Meta Buys Within, The Mistake People Are Making With the Metaverse. We kick things off with my thoughts on Niantic CEO John Hanke’s interview with The Verge’s Nilay Patel on his Decoder podcast. Hanke discussed some of the more intriguing topics and concepts found in the AR/VR/metaverse space. The discussion then turns to Meta (Facebook) buying Within. We go over two items that jumped out at me about the acquisition. The update concludes with the mistake that I see consensus making when it comes to metaverse analysis. (Dec 16, 2021)

The Amazon Event, Amazon’s Play for Neighborhoods, Amazon Astro. Today’s update will be focused on Amazon’s product event. We kick things off with my thoughts regarding Amazon’s product strategy involving ambient intelligence. The discussion then turns to Ring’s outsized presence throughout Amazon’s presentation. We go over Amazon’s play for neighborhoods and what is at stake. The update concludes with a closer look at the Amazon Astro. (Sep 29, 2021)

Here are the five most popular daily updates published in 2021 based on page views to AboveAvalon.com. There is naturally a tendency for updates published earlier in the year to outrank more recent updates.

Apple Designer Eugene Whang Left Apple, Apple Industrial Design Turnover, Spotify’s WSJ Op-Ed Against Apple (May 19, 2021)

Peloton Acquires Wearables Company, Peloton vs. Apple Watch, Facebook Talks Up Smartwatch as AR Controller (Mar 23, 2021)

Tesla’s Bitcoin Problem, Apple and Bitcoin Mining, Introducing My FY2022 Estimates for Apple (Feb 11, 2021)

Target to Open Mini Apple Stores, Apple’s Retail Store Growth Strategy, Thursday Q&A (Feb 25, 2021)

Apple Contemplating Apple Watch Explorer Model, Thinking About the Apple Watch Line, Apple Watch Partnerships (Mar 29, 2021)

Just 13% of the daily updates published in 2021 are highlighted in this article. The full archive consisting of all 182 daily updates is available here. Above Avalon membership is required to access the updates.

Daily Podcast

This was the first full year for the Above Avalon Daily podcast, the private podcast available to members who attached the podcast add-on to their membership. A total of 182 episodes were published, totaling nearly 40 hours of audio. The podcast allows members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. Since launch, reception of the daily podcast has exceeded my expectations with very positive listener feedback. More information on the daily podcast, including a few sample episodes, is found here. Once an Above Avalon member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Inside Orchard (Launched in 2021)

In March, I launched InsideOrchard.com as a home to my unique perspective on technology and its impact on society. Over the past nine months, 40 essays and corresponding podcast episodes were published. Although distinct from the analysis and discussion found with Above Avalon, the two sites can be thought of as siblings. A bundle consisting of both an Above Avalon membership and Inside Orchard subscription, with an accompanying price discount, was purchased by a good percentage of the Above Avalon member base.

Here’s to 2022

A big thank you goes out to readers, listeners, and members for making 2021 another successful year for Above Avalon. Have a safe and relaxing Christmas, holiday season, and New Year. See you in 2022. - Neil

Above Avalon Podcast Episode 187: Thoughts on Apple Watch Series 7

In episode 187, Neil discusses his initial observations wearing an Apple Watch Series 7. The episode also goes over Apple Watch strategy, puts the Series 7 into perspective, and discusses why Apple continues to sell Apple Watch Series 3.

To listen to episode 187, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

The Apple Watch Series 7 Is Great

Shortly after Apple’s virtual event last month concluded, some people wondered out loud if the Apple Watch Series 7 was a placeholder. The rumor hill was confident that Apple was going to extend the design language found with the iPhone and iPad by announcing an Apple Watch with flat edges. Instead, Apple unveiled an Apple Watch Series 7 display with curved edges. The apparent lack of other noteworthy features was then used by some as evidence of Apple rushing the Series 7 to unveil something in front of the holidays.

Nothing could be further from the truth.

For the past few days, I’ve been using an Apple Watch Series 7 (45mm - Aluminum Green). The best descriptive words regarding the Series 7 that come to mind are fun, fulfilling, and endearing. The Series 7’s targeted updates help to advance computing on the wrist while addressing some known friction points that had accompanied daily usage. There is nothing like the Apple Watch in the market, and Apple continues to run forward with a device ushering in a paradigm shift in computing.

The following are my initial impressions from using an Apple Watch Series 7.

Larger Screen. Apple Watch Series 7 marketing is anchored around the larger screen - and for good reason. Much to my surprise, reducing the display borders by 40% gives the Series 7 a completely different kind of Apple Watch experience. Instead of using the Series 7’s larger screen (20% larger than the Series 6) to include more text and information, Apple leveraged the additional screen real estate to make buttons and text larger. This was a smart decision. Instead of having Series 7 owners spend more time looking at their wrists, the larger screen makes it easier to quickly gather information and not get lost in the watch.

One way of describing the Apple Watch’s screen size changes over the years is that the Series 4 went after the low-hanging fruit. There was value found in simply fitting more stuff on a bigger screen. The Series 7 screen (50%+ larger than the Series 3) feels like the refinement step, focusing more on the finer things like larger font and click areas that end up having a larger impact on daily usage.

Larger Footprint. Apple Watch Series 7 has a slightly larger form factor than the Series 6 (45mm and 41mm vs 44mm and 40mm). The larger size on the wrist was not noticeable. The Series 7 Aluminum doesn’t feel heavier than the Series 6 either despite weighing 7% more. Weight becomes a bigger issue when moving to the Stainless Steel from Aluminum. As someone who has worn the Aluminum regularly for years, the Stainless Steel is too heavy for my taste. There will come a point at which the larger Apple Watch option starts to become unwieldy, but I don’t think we are at that point yet.

Apple Watch Series 6 (left) vs. Apple Watch Series 7 (right)

Setup. It took about 20 minutes to set up the Series 7 with an iPhone 13 Pro using Restore from Backup. Similar to how the iPhone setup process has become streamlined over the years, the days of needing to wait until the weekend to set up your new Apple Watch for fear of running into issues are over.

Brighter Screen. Similar to how the Series 7’s larger screen jumped out at me, the 70% brighter always-on screen was also noticeable. To the user’s eye, it pretty much seems like the Apple Watch screen has the same brightness regardless of one’s wrist position. With the Series 6, I found myself needing to tap the screen when in the “always-on” state and not in a direct line of sight because it wasn’t bright enough.

Color. Apple unveiled five new aluminum colors - Green, Blue, Product Red, Starlight, and Midnight. The green is very attractive, reminding me more of a greenish black. In certain light conditions, the Watch comes across as having a black case.

Battery Life. Apple has been following an “all day” battery life strategy for Apple Watch. Instead of removing Watch features to extend battery life to two to three days, Apple has strived to have Apple Watch battery life last as close to a full day as possible without the wearer needing a quick boost in the middle of the day. For the most part, Apple has been successful with that objective. Obviously, Apple Watch battery life is dependent on usage. Someone that goes heavy on workouts, podcast listening, and GPS will struggle getting through the whole day on a single charge. However, on average, the Apple Watch should last from a morning charge to getting ready for bed approximately 18 hours later.

In recent years, sleep tracking has complicated Apple’s battery goal for Apple Watch. It’s no longer enough for Apple Watch to last a full day. It also needs to last the subsequent night. Quick charge is Apple’s solution. In the amount of time someone takes to get ready for bed, an Apple Watch can get enough charge (~20%) to do six to eight hours of sleep tracking and then be ready for a longer (~45 minutes) charge in the morning.

Based on my rudimentary testing, the strategy holds true. Thanks to an updated charging architecture and fast-charging USB-C cable, I was able to charge the Apple Watch Series 7 from 0% to 82% in 45 minutes. That is favorable to Apple’s 80% battery charge in 45 minutes claim. As for Series 7 and Series 6 charging, I achieved 25% to 30% faster charging for the Series 7 using the same 20W USB-C power adapter for both the Series 7 and 6. Apple claims the Series 7 has “up to 33% faster charging” than the Series 6 when using a 20W USB-C power adapter with the Series 7 and a 5W USB power adapter with the Series 6.

In practice, does all of this battery life strategizing work for the average Apple Watch wearer? The short answer is “yes.” Most Apple Watch wearers will likely end up getting through the day and night on a single charge. A roughly 30 minute charge in the morning will then be enough to get through the following day. Of course, there is room for Apple to improve Apple Watch battery life. There will likely always be room for battery life improvement.

Full-Size Keyboard. Two words: scary good. I was impressed with Apple’s slide-to-text technology that relies on machine learning to predict what I’m typing. Heading into the Series 7, my view was that tapping or sliding on an Apple Watch screen to write messages or emails didn’t make much sense. Instead, dictation was the way forward. That idea hasn’t completely gone away for me. It’s still faster to dictate messages on the wrist instead of typing. However, using voice for dictation has its limitations, especially when it comes to privacy. It’s just not practical or useful to use voice to dictate messages when in meetings or public settings. By including a built-in full-size keyboard for the first time (third-party options were previously available), Apple has essentially given the Apple Watch a new user input.

In a related note, as discussed above, the larger touch areas made possible by the 20% larger screen really do make a difference. For example, it’s easier and more enjoyable using the calculator app.

Putting the Series 7 Into Perspective. As someone who has worn an Apple Watch daily for the past six years, the Series 7 is up there with the Series 4 as being the most noteworthy upgrade to date. It’s that good. That may come off as surprising given the lack of new features found with the Series 7. However, quality always trumps quantity when it comes to new features. The primary reason for the Series 7 receiving such a high honor is that a larger screen plays a very big role in my day-to-day Apple Watch experience. The wrist is among some of the most valuable real estate for computing, and a larger Apple Watch screen takes advantage of that premium real estate.

At the same time, Apple’s ongoing dedication to Apple Watch’s rectangular design heritage is appreciated. Apple could certainly go in different directions with Apple Watch case design, but the company’s continued commitment to positioning Apple Watch as a general computing device ends up being met with a screen designed to display text and information. Apple’s focus on maintaining all-day battery life despite larger power requirements, like a brighter and larger screen, is also something that can’t be ignored.

One Final Thing About the Series 3. Apple continues to sell the Apple Watch Series 3 alongside the flagship Series 7. Apple is relying on a different strategy here than with the iPhone and iPad. By not keeping last year’s Apple Watch series around, Apple ended up creating a larger gap in feature set between models. The end result is more people opting for the latest and greatest. When comparing the Series 7 to the Series 3, it’s no surprise that the Series 7 will grab the majority of sales. Interestingly, the Apple Watch SE (basically a rebranded Series 4) wasn’t updated last month either. This will only serve to funnel additional sales to the Series 7.

There are a few reasons for Apple to keep the Series 3 in the lineup. Price is a big one. For some users, budget is the most important purchasing consideration. The Series 3 is just $199 in comparison to $399 for Series 7 GPS. The Series 3 also prevents a price umbrella from forming under the flagship model. With the Series 3 still available for sale, it’s difficult for an Apple Watch competitor to gain traction in the $150 to $200 range. Despite being four years old, the Series 3 can still hold its own relative to the competition. That just goes to show how far Apple is with its wearables strategy.

As someone who has used both the Series 3 and now Series 7, the difference between the two models is like day and night. It’s hard to imagine going from a Series 7 back to a Series 3. The $200 price gap comes across as small. The thing is, the Apple Watch is a new user story. Unlike the iPhone, Apple Watch sales are driven by customers buying their first Apple Watch. A Series 3 still beats a bare wrist.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from October 14th.

Above Avalon Podcast Episode 184: Let's Talk WWDC 2021

In episode 184, Neil discusses the big themes found with this year’s WWDC. The episode then takes a deep dive into watchOS direction and what Neil sees as missed opportunities for unleashing more of Apple Watch’s potential.

To listen to episode 184, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Above Avalon Podcast Episode 180: 100 Million Wrists

According to Neil’s estimate, 100 million people now wear an Apple Watch. This means that approximately 10% of iPhone users wear an Apple Watch. In episode 180, Neil discusses these installed base and adoption figures as part of a larger discussion regarding Apple Watch’s sales momentum, growth potential, and roles in Apple’s ecosystem

To listen to episode 180, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Above Avalon Podcast Episode 174: Apple Watch Is a Runaway Train

While the tech press spent years infatuated with stationary smart speakers and the idea of voice-only interfaces, it was the Apple Watch and utility on the wrist that ushered in a new paradigm shift in computing. In episode 174, Neil discusses how Apple Watch momentum is building. The product category resembles a runaway train as no company is in a position to slow it down. Additional topics include the stationary smart speaker mirage, Neil’s Apple Watch installed base estimates, how Apple Watch derives its momentum, and Apple’s health platform.

To listen to episode 174, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive the latest Above Avalon podcast episode:

Apple Watch Forced Fitbit to Sell Itself

Saying that a company with an agreement to be acquired for $2.1 billion was killed may sound like an exaggeration. Many start-ups aim to one day be “killed” in such fashion. However, Google’s decision to acquire Fitbit amounts to a mercy kill, putting an official end to Fitbit’s implosion at the hands of Apple Watch. In just three years, the Apple Watch turned Fitbit from a household name as the wearables industry leader into a company that will eventually be viewed as an asterisk when the wearables story is retold to future generations.

The Offer

When news first broke that Google LLC had offered to acquire Fitbit for $2.1 billion, or $7.35 per share, many observers noted how low the offer price was compared to Fitbit’s earlier valuations. This was a company that had its initial public offering at a $4.1 billion valuation and had seen its stock price peak at a $13 billion valuation ($51.90 per share).

My initial reaction was that Google was being extremely generous with its offer. On an enterprise value basis, which excludes $565 million of cash and cash equivalents on Fitbit’s balance sheet, Google is valuing Fitbit at $1.5 billion. For a hardware company with $1.5 billion of annual revenue and declining ASP and margins, questionable intellectual property, a dying ecosystem, and a non-existent product strategy, Google looks to be overpaying for Fitbit.

Industry observers speculate that Google’s offer price reflects the company seeing something in Fitbit that the marketplace missed. Instead, Google’s generous offer price has the makings of being a goodwill gesture aimed at Fitbit employees who have wealth tied to Fitbit stock. The $7.35 offer price represents close to a three-year high in Fitbit’s stock price. Holding Fitbit’s feet to the fire in terms of valuation wouldn't have helped Google retain Fitbit employees for beefing up its fledging hardware team.

On the flip side, Fitbit co-founder and CEO James Park and the board deserve a round of applause for securing such a generous offer from Google. The acquisition can be viewed as Google offering Fitbit a dignified and gracious death and Fitbit’s board as correct to take the opportunity.

Fitbit’s Story

There are two chapters to Fitbit’s life as an independent company. From 2013 to 2016, Fitbit leveraged low-cost, relatively rudimentary fitness tracker bracelets worn on the wrist to consolidate what had been a fragmented market for quantifying one’s physical movement. Fitbit even managed to move into the realm of coolness. Wearing a Fitbit in public contained positive connotations as the user was viewed as being on the forefront of technology. The smartphone revolution also played a role in Fitbit’s rise as people became comfortable giving a new crop of mobile devices an increasing number of roles to handle.

During the early years, Park successfully navigated Fitbit through a tumultuous period that included the company recalling the Fitbit Force for causing skin rashes and burns on nearly 10,000 people. Park also competed effectively against other early wearables pioneers. An ugly battle with the well-funded Jawbone regarding intellectual property theft ended in a settlement. Fitbit became a household name for health and fitness tracking.

Everything changed in 2016. Fitbit’s unit sales, as shown in Exhibit 1, peaked. On the surface, the subsequent decline in unit sales may not have looked too bad considering that demand stabilized around 15M units per year. However, for a hardware company dependent on rising unit sales, the development was alarming. Once again, Fitbit management did the right thing and quickly cut expenses at the first sign of demand weakness. The belief was that Fitbit could manage its way out of the sales slump.

Exhibit 1: Fitbit Unit Sales (Annual)

What management did not realize at the time was that Fitbit was beginning to feel the consequences of one giant mistake that Park had made years earlier. Park did not foresee the fundamental change that would take place on the wrist in the form of dedicated fitness trackers turning into full-fledged computers. Smartwatches aren’t just gloried fitness trackers. Instead, smartwatches are alternatives to smartphones and tablets.

After dragging his feet for far too long, Park knew that the only way forward for Fitbit would be to come out with a smartwatch. With the $300 Ionic, Fitbit launched its first smartwatch in 2017. The device flopped. Fitbit quickly pivoted to a lower-cost smartwatch with the $200 Versa. Once Fitbit had established channel inventory and satisfied pent-up demand for the Versa in its existing installed base, demand evaporated. Despite an even lower price, the Versa has failed to catch in the marketplace.

Why Sell?

In early 2019, Fitbit management began waving the white flag when it decided to pivot yet again, this time into services. In an effort to grab more users who could be monetized via paid services, Fitbit management began to cut into hardware pricing and margins. With the all-important 2019 holiday shopping season quickly approaching, Fitbit’s situation looked dire. Enter Google last week to officially put Fitbit out of its misery.

The only alternative for Fitbit, which was far from unproven, would be for the company to become a much smaller company, essentially a shell of its former self, in order to sell a certain number of dedicated fitness trackers each year to a declining installed base. Even if successful, Fitbit would have looked and acted like nothing that the world had come to know Fitbit as - a leader in the wearables category. Fitbit would instead become something of a zombie company.

How did Fitbit go from being considered the wearables leader to viewing a $2.1B acquisition as its best hope for shareholders to recoup any value? What led Fitbit to run out of options as an independent company?

Two words: Apple Watch.

Redefining the Industry

Apple didn’t just steal customers away from Fitbit. In such a scenario, Fitbit may actually have had a chance to survive as the company could have had a means to respond competitively. Apple ended up doing something that ultimately proved far worse for Fitbit. The Apple Watch altered the fundamentals underpinning the wrist wearables industry. This left Fitbit unable to remain relevant in a rapidly-changing marketplace.

Apple placed a bet that wrist real estate was being undervalued. The Swiss had dropped the ball and were primarily selling the wrist as a place for intangibles with high-end mechanical watches. Instead of following Fitbit and selling a $99 dedicated fitness tracker, Apple looked at the wrist as being a great place for additional utility beyond just telling time or tracking one’s fitness and health. Apple turned health and fitness tracking from a business into a feature. The Apple Watch redefined utility on the wrist.

This change led to consumers wanting more from wrist wearables. Apple Watch established a stronghold at the premium end of the market. Taking a page from its product strategy playbook, Apple then methodically began to lower entry-level Apple Watch pricing, which had the impact of removing oxygen from increasingly lower price segments. Fitbit was squeezed as the company had no viable way to compete directly with Apple Watch. Fitbit’s existing business wasn’t profitable enough for management to ramp up R&D in an effort to go up against Apple. Fitbit had generated just $200M of free cash flow over the past five years. Apple spends that much on R&D in a few days. Meanwhile, competition remained intense at the low-end of the market, which only added pressure to Fitbit’s existing business of selling low-cost dedicated fitness trackers.

Exhibit 2 highlights the number of active Fitbit users compared to the Apple Watch installed base (the number of people wearing an Apple Watch). The Apple Watch figures are my estimates. The exhibit ends up being the most damning evidence of Fitbit’s demise. Fitbit’s installed base lost all momentum just as Apple Watch began to take off. Unit sales trends continue to hide this deterioration in Fitbit’s installed base fundamentals. While Fitbit claims to have 28 million active users, that total isn’t enough to sustain a thriving ecosystem. In addition, there are valid reasons to question the loyalty and engagement found with those users.

A good argument can be made that Fitbit died a while ago, and the company is merely running on fumes from the dedicated fitness tracker glory days. With Fitbit, Google is acquiring a dying wearables platform.

Exhibit 2: Number of Active Users (Fitbit versus Apple Watch)

Fitbit and Google

There is no rationale argument in support of Google buying Fitbit. Both companies lack a workable strategy in wearables. Fitbit doesn’t bring anything to the table for Google. Buying a fitness and health tracker going off of fumes is not a legitimate way to find success in wearables. Not only did Fitbit lack a sustainable product strategy going forward, but it’s fair to assume that Fitbit products will become even less attractive following a Google acquisition.

When a services company with data-capturing tools buys a dying hardware ecosystem built on tools that weren’t just data-capturing tools in disguise, an exodus of users is likely. Judging by how Fitbit decided to include the following paragraph in the press release announcing the acquisition, both companies are acknowledging the exodus risk:

“Consumer trust is paramount to Fitbit. Strong privacy and security guidelines have been part of Fitbit’s DNA since day one, and this will not change. Fitbit will continue to put users in control of their data and will remain transparent about the data it collects and why. The company never sells personal information, and Fitbit health and wellness data will not be used for Google ads.”

That paragraph won’t provide any comfort to Fitbit users concerned about their privacy in a post-Google acquisition. However, that didn’t matter to Fitbit’s board when accepting Google’s offer as their concern was found with Fitbit shareholders, not Fitbit users.

Success in Wearables

Many industry analysts, possibly in an effort to appease Google’s ego, have been going around talking up Fitbit as having a treasure trove of data for Google. The narrative concludes with Google somehow turning this data into an ingredient for success in wearables. This line of thinking makes no sense and is nothing more than wishful thinking.

Google’s problem in wearables isn’t due to a lack of data. In addition, Google’s lack of silicon expertise and dependency on Qualcomm aren’t fatal issues either. Ultimately, Google’s problem in wearables is that it isn’t a design company. At Google, designers are not given control over the user experience. Even if Google ramps up investment and hiring so that it is able to one day ship custom silicon that is competitive with Apple, the company would still need to come up with wearables that people want to be seen wearing. These products need to be born from a design culture in which the way people use technology is given more importance than just pushing technology forward.

Instead of acquiring Fitbit to find success in wearables, Google should work on changing its internal culture to empower designers at the expense of engineering. However, that change isn’t likely to materialize as the people who would be tasked with making such a decision would themselves hold less power and importance as a result of the change.

Fitbit will serve as a case study for what happens to a company underestimating Apple’s ability to redefine not just a product category, but an entire industry. Apple’s culture allows it to succeed in wearables. The company has spent decades learning to make technology more personal, and those lessons are being used to establish the most formidable wearables platform in existence. Apple Watch redefined what it meant to put utility on the wrist, and Fitbit simply wasn’t built to succeed in such a world.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple 4Q19 Earnings Expectation Meters

There is increased attention around Apple’s 4Q19 results. Apple shares are up 19% since the company reported 3Q19 results back on July 30th. Since the start of the year, AAPL shares are up 58% while the S&P 500 is up 21%. For a trillion dollar market cap company, such outperformance is noteworthy.

Apple’s strong stock performance has led to questions regarding what management will have to announce on Wednesday to meet or exceed expectations. At the same time, Apple’s 4Q19 results have the potential of containing some noise as Apple works through its flagship iPhone and Apple Watch launch. For example, the iPhone was not in demand / supply equilibrium by quarters end.

The following table contains my overall estimates for Apple’s 4Q19. My expectation is for Apple to report strong 4Q19 results and 1Q20 revenue guidance.

A detailed discussion of these estimates, including the methodology and perspective behind the numbers, is found in my Apple 4Q19 earnings preview available here. Above Avalon membership is required to read my earnings preview.

Each quarter, I publish expectation meters ahead of Apple's earnings release. Expectation meters turn single-point financial estimates into more useful ranges that aid in judging Apple's business performance. In each expectation meter, the white shaded area reflects my official single-point estimate. The gray shaded area represents a result that is considered near my estimate. A result that falls within this gray area signifies that the product or variable being measured is pretty much performing as expected. A result that falls in the green shaded area denotes strong performance and the possibility of me needing to raise my expectations for that particular item going forward. Vice versa, a result falling in the red shaded area denotes the possibility of needing to reduce my expectations going forward.

Over the years, the expectation meters have evolved with Apple’s changing business and financial disclosures. Ahead of Apple’s 4Q19 earnings, I am publishing three expectation meters:

Products vs. Services Revenue

iPhone vs. non-iPhone Revenue

1Q20 Revenue Guidance

Products vs. Services

Apple breaks out revenue into two categories: products (i.e. hardware) and services. The iPhone likely weighed on Apple’s 4Q19 products revenue due to both declining unit sales and a lower average selling price (ASP). The end result is products revenue that will show little to no growth. Partially offsetting lackluster growth in products, Apple’s Services revenue is expected to grow in the vicinity of 15%. This dynamic will likely improve in FY2020 as both products and services will once again contribute to Apple revenue growth.

iPhone vs. Non-iPhone

Another way of thinking about Apple’s business is to allocate the company’s various products and services into two buckets: iPhone and non-iPhone. Last quarter, Apple’s non-iPhone business registered more revenue than the iPhone business for the first time since 2012. It is unlikely that this dynamic will repeat itself in 4Q19 as the iPhone business gains revenue momentum due to the flagship iPhone launch.

Guidance

Consensus expects Apple to report $86B of revenue in 1Q20. That seems on the light side. My estimate is for Apple to announce 1Q20 revenue guidance in the range of $88B to $91B. Apple has to report more than $88.3B of revenue in 1Q20 to reach a new all-time record for quarterly revenue.

Apple has two tailwinds for issuing strong 1Q20 revenue guidance:

Apple is facing one of the easier year-over-year quarterly compares in years given the demand implosion in China seen in November and December 2018. This will make it that much easier for Apple to report revenue growth in 1Q20.

The environment is conducive to both Apple Watch and AirPods selling well during the 2019 holiday shopping season. Apple not only faces a lack of genuine smartwatch or wireless headphone competition, but also has strong product lines with attractive entry-level pricing available.

On the flip side, one headwind worth monitoring is declining iPhone ASP. Apple cut pricing of its lowest-priced flagship iPhone by $50. In addition, Apple remains aggressive with pricing outside the U.S.

Despite Apple’s strong stock price outperformance so far this year, the company continues to have the lowest forward valuation multiples among the Wall Street giants. A good argument can be made that Apple’s strong stock price outperformance in 2019 hasn’t been driven by expectations of strong 4Q19 numbers or even solid 1Q20 guidance. Instead, the marketplace may be betting on improved visibility around Apple’s financials through FY2021. The environment is becoming more hospitable for iPhone revenue growth to return in FY2020. At the same time, Apple wearables continue to gain momentum. There is then growing smoke around the idea of Apple potentially having a busy first half of CY2020 from a new product perspective.

My working Apple earnings model as well as my granular 4Q19 estimates including unit sales, ASP, and margin expectations, are available here. Above Avalon membership is required to read my full 4,000-word earnings preview. Access to my model is available to members at no additional cost.

My Apple earnings review will be made available exclusively to Above Avalon members. To have the review sent directly to your inbox once published, sign up at the membership page.