Apple 3Q24 10-Q Takeaways, A Few Interesting Tidbits About Apple’s Share Buyback, Apple’s Free Cash Flow Margin

Today’s update will wrap up Neil’s 3Q24 Apple earnings review. We will examine Apple’s 3Q24 10-Q and the latest balance sheet and cash flow trends.

Here is how our review went:

Aug 7th: Secondary themes and charts

Aug 8th: Earnings call Q&A examination

Today: 10-Q, buyback, free cash flow

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Above Avalon Membership

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

More on Apple Share Buyback vs. Market Cap, Thoughts on Apple and a $4 Trillion Market Cap, Thursday Q&A

There is one question that was carried over from last week’s Thursday Q&A that we will address today. What does the current Mac upgrade cycle look like? In addition, there were a few incoming questions regarding Apple’s market cap and buyback. We will tackle those questions first.

An Above Avalon membership is required to read this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time.

An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-on.

Apple Share Buyback Update, Apple's Paid Subscriptions Growth Update

Hello everyone. Today’s update will conclude our Apple 4Q23 earnings review. It’s been a busy week and we covered A LOT of ground. There are a few broader topics dealing with the Mac and iPad that extend far beyond any one earnings report. We will address / tackle those topics in due time.

As a recap, here were the earnings review sections:

November 3rd: Initial Impression From Apple’s 4Q23 Earnings, Key Numbers From Apple 4Q23, About Apple’s 1Q24 Guidance

November 6th: Three Interesting Charts for Apple’s 4Q23

November 7th: Reading Between the Lines of Apple’s 4Q23 Earnings Q&A With Analysts

November 8th: Apple 2Q23 10-K Takeaways

In today’s update, we will discuss Apple’s share buyback trends and paid subscription tally.

Apple Share Buyback Update

There were a few interesting observations regarding Apple’s share buyback activity.

Here is quarterly data from the past three years for Apple's share buyback via open market transactions:

4Q20: $18.0B. Average repurchase price per share: $106.68

1Q21: $24.0B. Average repurchase price per share: $120.19.

2Q21: $19.0B. Average repurchase price per share: $128.89.

3Q21: $17.5B. Average repurchase price per share: $128.48.

4Q21: $20.0B. Average repurchase price per share: $146.41.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple 2Q23 10-Q Takeaways, Apple's Share Buyback Update, More on Apple’s Stingy Dividend Increases

Happy Tuesday.

In today’s update, we will go over Apple’s 2Q23 10-Q. We will then discuss Apple’s buyback and cash dividend programs.

Let’s jump right in.

Apple 2Q23 10-Q Takeaways

Published at the end of FY1Q, 2Q, and 3Q, 10-Q filings provide additional commentary and disclosures regarding a company's business and financial results.

The following items from Apple's 2Q23 10-Q jumped out at me.

Product Details. Apple provided additional commentary behind sales trends for its major product categories.

iPhone. Net sales were flat in 2Q23. Based on that wording, it sounds like higher ASP was not a major factor in iPhone revenue growth. In the past, Apple has called out a different mix of iPhone models to hint at ASP changes. For reference, the last time Apple called out iPhone mix in the 10-Q, ASP likely was up 10%+ year-over-year. For 2Q23, we are looking at a much smaller increase in ASP given FX headwinds.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple 1Q23 10-Q Takeaways, Apple's Share Buyback Update, Revisiting Apple’s Cash Neutral Goal (Daily Update)

Hello everyone. Today’s update will conclude our Apple earnings review as we go over Apple’s 1Q23 10-Q and focus on some balance sheet items (share buyback pace and Apple’s cash neutral goal). The plan is to include an updated version of Neil’s Apple earnings model in tomorrow’s update. Let’s jump right in.

Apple 1Q23 10-Q Takeaways

Published at the end of FY1Q, 2Q, and 3Q, 10-Q filings provide additional commentary and disclosures regarding a company's financial results.

The following items from Apple's 1Q23 10-Q jumped out at me. We will discuss Apple’s share buyback shortly.

Product Details. Apple provided additional commentary behind sales trends for its major product categories.

iPhone. Net sales decreased in 1Q23 due “primarily to lower net sales from the Company’s new iPhone models.” The comment is referring to Apple not being able to report iPhone unit sales growth due to iPhone 14 Pro and Pro Max shortages.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

More on Apple’s Buyback Plan, It’s All About Apple Free Cash Flow, Iger vs. Chapek (Daily Update)

We begin today’s update with a few additional takeaways from Neil’s new report on Apple’s share buyback program. The discussion then turns to a key different between Bob Iger and Bob Chapek and what it means for Disney’s approach to blockbuster movies.

Hello everyone. Welcome to a new week. It’s good to be back after a few days off.

The newest Above Avalon Report was published last Wednesday. You can find “Apple’s Share Buyback: What Comes Next?” in your inbox or via the archive (here). You can use this link to have friends/co-workers/family sign up as members before accessing the report. As a reminder, an audio version of the report was also recorded and released to members with the podcast add-on attached to their membership. To get the add-on, fill out this form.

Let’s jump into today’s update.

More on Apple’s Buyback Plan

The newest Above Avalon Report examined where things currently stand with Apple’s share buyback program and what the future will likely bring.

In recent years, somewhat of an understanding has taken hold when it comes to Apple’s buyback. Wall Street is not as doubtful about Apple’s ability to fund both share buyback and its investment opportunities (capex, R&D, M&A). This doesn’t mean that Apple’s share buyback lacks unknown.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple’s Share Buyback: What Comes Next? (Above Avalon Report)

An examination of Apple’s buyback strategy in relation to its net cash neutral goal.

Written by Neil Cybart

Apple has the largest share buyback program in the world. With $90 billion put into buyback in just the past 12 months, the company’s buyback strategy continues to draw questions.

What is Apple’s ultimate objective in repurchasing shares?

What will happen to Apple’s buyback program once the company reaches its net cash neutral goal?

This report examines Apple’s share repurchase program, including the technical details and mechanisms behind buyback, the motivating factors for continued share repurchases, and the most likely path forward from a capital management perspective once Apple reaches its net cash neutral goal.

What Are Share Repurchases?

Share repurchases are the reverse mechanism of a company issuing stock. A company’s board of directors authorizes the use of cash on the balance sheet to buy back shares from existing shareholders. In most cases, repurchased shares are retired and taken out of circulation, thereby reducing a company’s share count.

Technical Details

There are three ways for a company to buy back shares:

An Above Avalon membership is required to continue reading this report. Members can read the full report here. An audio version of this report is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Reports are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Member Privileges and Benefits

Receive Exclusive Daily Updates. The cornerstone of Above Avalon membership is access to Neil’s exclusive daily updates about Apple. Updates are sent via email and go over current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Approximately 200 daily updates are published throughout the year. Sample daily updates can be viewed here, here, and here.

Receive Exclusive Reports. Members have access to Neil’s reports, which are in-depth examinations of Apple's business, product, and financial strategy.

Access Private Podcasts. Members have the option of attaching a podcast add-on to their membership in order to receive the daily updates and reports in audio form.

Access Neil’s Earnings Model. Members have access to Neil’s working Apple earnings model (an Excel file that also works in Numbers). The model is fully functional and adjustable and provides the ability to alter earnings drivers.

Email Priority. Receive priority when it comes to having email questions and inquiries answered. Neil personally answers all inquiries, including customer service matters related to your membership.

Archive Access. Read 1,200+ daily updates and reports that have been previously sent to members. The Above Avalon member archive is unmatched in the marketplace in terms of the sheer amount of Apple analysis found in one location. The daily updates archive can be viewed here while the reports archive is available here.

Member Forum Access. Join other Above Avalon members in an active forum containing in-depth discussion and debate. Neil moderates and participates in the forum. The forum is run through Slack and can be accessed here.

Virtual Meet-ups. Talk with Neil about Apple and other related items in virtual meet-ups held via Slack throughout the year.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent source of Apple analysis. Above Avalon is fully sustained by its members.

Above Avalon Year in Review (2021)

Heading into 2021, Apple had just gone through one of the more tumultuous years in its existence. As discussed in last year’s Year in Review, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. Expectations that 2021 would be much smoother turned out to be optimistic. While society did largely open up halfway through the year, which allowed Apple’s retail apparatus to return to normal operations, Apple continued to face once-in-a-few-decades challenges when it came to the supply chain, product manufacturing, and navigating its 154,000 employees through a pandemic.

According to my estimate, Apple experienced $10 billion of unmet demand in 2021 as a result of supply chain issues. This total is on top of lingering demand issues associated with wearables that arose from the pandemic.

Despite the challenges, 2021 was a record year for Apple on a number of business fronts:

Apple sold 260M+ iPhones - a record high for a 12-month period.

Apple sold 25M Macs - a record high for a 12-month period.

The Apple Watch installed base surpassed 100 million people.

Articles

In 2021, I published 10 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s ecosystem continues to gain strength and is ready for the next major product category launch (a mixed reality headset).

Here are a few of my favorite articles published in 2021 (in no particular order):

Apple Has a Decade-Long Lead in Wearables. AssistiveTouch allows one to control an Apple Watch without actually touching the device. A series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The technology is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years, but more like a decade.

Apple Won the Share Buyback Debate. I receive many questions about Apple from Above Avalon readers, listeners, and members. In previous years, one topic has been far ahead of any other as a source of questions. Everyone wanted to know about Apple’s share buyback program. Something interesting happened in 2020. I received far fewer questions about Apple’s share buyback program. To be precise, I didn’t receive an incoming question about buyback in nine months - from when the stock market put in a bottom in April 2020 to the start of 2021. What explains such a dramatic change? The Apple share buyback debate ended, and Apple was declared the winner.

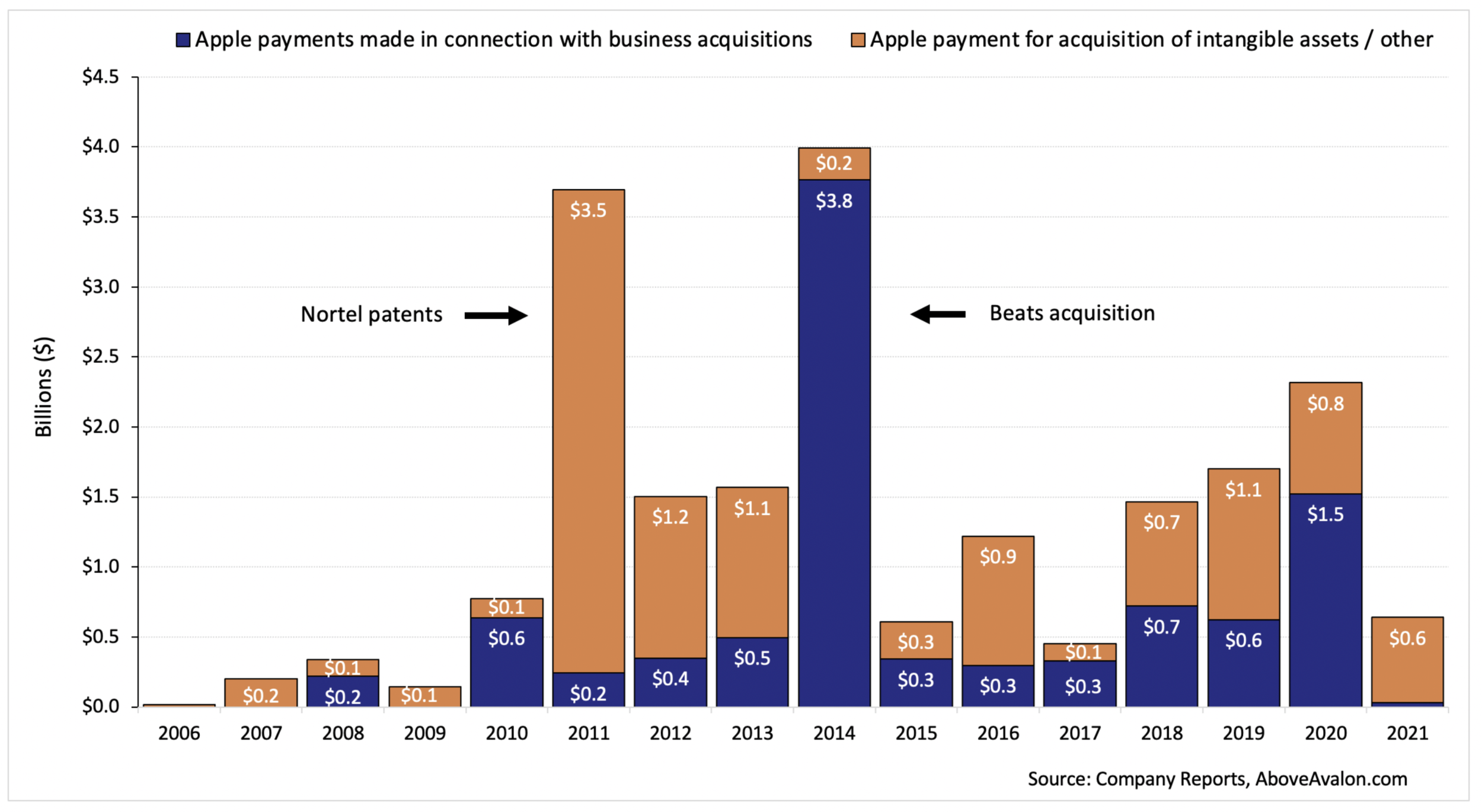

Apple’s Extremely Quiet Year for M&A. While going through Apple’s 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In 2021, Apple spent just $33 million on business acquisitions (M&A). That’s a record low for Apple with Tim Cook as CEO. It’s a number that deserves further investigation as Apple’s M&A strategy and philosophy play a big role in how Apple was able to get to where it is today.

The five most popular Above Avalon articles in 2021, as measured by page views, were:

Podcast Episodes

There were 11 episodes of the Above Avalon podcast recorded and published in 2021, totaling 4.5 hours. The podcast episodes that correspond to my favorite articles are found below:

Charts and Exhibits

The following charts and exhibits found in Above Avalon articles published in 2021 were among my favorites.

Apple Wearables Unit Sales (2017 to 2021) - from Apple Has a Decade-Long Lead in Wearables

According to my estimate, Apple is on track to sell 105 million wearable devices in 2021. That total represents 40% of the number of iPhones sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Percentage of Apple Revenue Through Direct Distribution Channel - from The Future of Apple Retail

The percentage of sales going through Apple’s direct distribution has gradually increased in recent years. The increase in sales percentage has likely been boosted by services revenue, more sales going through Apple’s website, and more iPhone upgrading taking place through Apple.

Note: Direct distribution channel includes Apple’s website, Apple stores, and direct sales force.

Apple M&A (Cash Payments) - from Apple’s Extremely Quiet Year for M&A

Since 2006, Apple has spent $20.6 billion on M&A with about half of the total tied to “business acquisitions.” The median is $1 billion per year. However, in 2021, Apple spent just $33 million on business acquisitions. That is the lowest amount since 2009 when Steve Jobs was still Apple CEO.

Daily Updates

In 2021, I published 182 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 182 updates are equivalent to five books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Project Titan Moving Forward

Along with mixed reality and AR, transportation is one of the largest areas of opportunity when thinking of future Apple products and services. The year turned out to be the busiest one yet when it came to Project Titan news as Apple began to seek supply chain and manufacturing partners.

Hyundai Confirms Talks With Apple, Apple Considering Car Factory in Georgia, Making Sense of Apple and Hyundai News (Jan 12, 2021)

Apple Car and the Last Mile, Revisiting an Apple Campus Shuttle Service, Thursday Q&A (Feb 4, 2021)

Apple’s Kevin Lynch Joins Project Titan, Apple Car Implications, Apple Watch Implications (Jul 19, 2021)

Doug Field Leaves Apple for Ford, Project Titan’s Trajectory and Leadership, Silicon Valley vs. Detroit (Sep 8, 2021)

Kevin Lynch Tapped to Lead Project Titan, Disillusionment in the Auto Space Is Setting In, Ted Lasso Wins Big at the Emmys (Sep 20, 2021)

Changes in Paid Video Streaming Land

Given the rush of new players into the paid video streaming space in 2020, there was quite a bit of movement in 2021. AT&T’s decision to spin off WarnerMedia was an industry-shaking event. As the months went on, it became clear that many content distribution services were experiencing something equivalent to a pandemic air pocket as subscriber trends became noisy. Netflix and Roku ran into friction while the true new kid on the block (Apple TV+) regained momentum with new shows and movies coming online in the back half of the year.

AT&T to Spin Off WarnerMedia, HBO Max’s Future, Apple Implications May 17, 2021

WarnerDiscovery and Apple M&A, Ranking Paid Video Streaming Leaders, Netflix Contemplating Move into Gaming May 26, 2021

The App Store’s Day in U.S. Court

The well-publicized Epic Games vs. Apple trial resulted in a resounding legal victory for Apple. It ended up being difficult to grasp just how poor of a job Epic Games did in trying to paint Apple as a monopoly. While the court did order Apple to change its anti-steering provision in the U.S., Apple won a stay by a court of appeals. The outcome with the highest probability is for the anti-steering provision to remain as is which would signal Apple’s very strong legal footing as it pertains to the App Store.

Epic Games vs. Apple, Epic's Arguments Against Apple, Epic’s Motivation Apr 27, 2021

Thoughts on the Epic Games vs. Apple Ruling Sep 13, 2021

When looking at my daily updates published in 2021, selecting a few favorites out of 196 updates was not easy. The following updates stood out to me (in no particular order):

Warren Buffett’s Annual Letter, Apple Isn’t Buffett’s Token “Tech” Stock, Apple, Buffett, and Buyback. We kick off today’s update with my thoughts on Warren Buffett’s 2020 letter to Berkshire Hathaway shareholders. Berkshire is Apple’s largest individual shareholder. The discussion then turns to why I don’t agree with those claiming Apple is Buffett’s token tech stock. We conclude by looking at share buyback and how the capital return mechanism leads to a wealth transfer event. (Mar 2, 2021)

Peloton Recalls All of Its Treadmills, The At-Home Fitness Revolution Needs a Reset, Apple, Fitness Machines, and Gyms. Today’s update will be focused on the at-home fitness industry. It’s a market that Apple moved deeper into a few months ago with Apple Fitness+. A good argument can be made that at-home fitness impacts other Apple devices as well especially Apple Watch and Apple TV. We kick things off with my thoughts on Peloton recalling all of its treadmills. The discussion then turns to why I think the at-home fitness industry needs a reset. The update concludes with how fitness equipment safety, or the lack thereof, impacts Apple and why I continue to think there will be a role for gyms to play in the future. (May 6, 2021)

Tesla Buys Bitcoin, Apple and Bitcoin, Apple and Crypto Exchanges. Today’s update will be focused on bitcoin. We begin with news of Tesla buying $1.5B of bitcoin. We then turn to my thoughts on whether or not Apple should follow Tesla into bitcoin. The update concludes with a closer look at RBC Capital Market’s suggestion that Apple should move into cryptocurrency exchanges. We go over why I don’t think the firm’s analysis passes the small test. (Feb 10, 2021)

Apple’s Services Journey, A Different Way of Thinking of Apple One, Apple Services Evolution. For the first time in what feels like a long time, the Apple news cycle is taking a breather. This provides us with an opportunity to pursue some original topics. We kick off today’s update with my thoughts on the narrative surrounding Apple’s Services business. Things are starting to change. The discussion then turns to how I think about Apple’s Apple One bundle and how reframing Apple One leads to some interesting questions and ideas as it pertains to the competition. The update concludes with my thoughts on the future factors determining where Apple Services are headed. (Jul 13, 2021)

Niantic CEO Pours Cold Water on the Metaverse, Meta Buys Within, The Mistake People Are Making With the Metaverse. We kick things off with my thoughts on Niantic CEO John Hanke’s interview with The Verge’s Nilay Patel on his Decoder podcast. Hanke discussed some of the more intriguing topics and concepts found in the AR/VR/metaverse space. The discussion then turns to Meta (Facebook) buying Within. We go over two items that jumped out at me about the acquisition. The update concludes with the mistake that I see consensus making when it comes to metaverse analysis. (Dec 16, 2021)

The Amazon Event, Amazon’s Play for Neighborhoods, Amazon Astro. Today’s update will be focused on Amazon’s product event. We kick things off with my thoughts regarding Amazon’s product strategy involving ambient intelligence. The discussion then turns to Ring’s outsized presence throughout Amazon’s presentation. We go over Amazon’s play for neighborhoods and what is at stake. The update concludes with a closer look at the Amazon Astro. (Sep 29, 2021)

Here are the five most popular daily updates published in 2021 based on page views to AboveAvalon.com. There is naturally a tendency for updates published earlier in the year to outrank more recent updates.

Apple Designer Eugene Whang Left Apple, Apple Industrial Design Turnover, Spotify’s WSJ Op-Ed Against Apple (May 19, 2021)

Peloton Acquires Wearables Company, Peloton vs. Apple Watch, Facebook Talks Up Smartwatch as AR Controller (Mar 23, 2021)

Tesla’s Bitcoin Problem, Apple and Bitcoin Mining, Introducing My FY2022 Estimates for Apple (Feb 11, 2021)

Target to Open Mini Apple Stores, Apple’s Retail Store Growth Strategy, Thursday Q&A (Feb 25, 2021)

Apple Contemplating Apple Watch Explorer Model, Thinking About the Apple Watch Line, Apple Watch Partnerships (Mar 29, 2021)

Just 13% of the daily updates published in 2021 are highlighted in this article. The full archive consisting of all 182 daily updates is available here. Above Avalon membership is required to access the updates.

Daily Podcast

This was the first full year for the Above Avalon Daily podcast, the private podcast available to members who attached the podcast add-on to their membership. A total of 182 episodes were published, totaling nearly 40 hours of audio. The podcast allows members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. Since launch, reception of the daily podcast has exceeded my expectations with very positive listener feedback. More information on the daily podcast, including a few sample episodes, is found here. Once an Above Avalon member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Inside Orchard (Launched in 2021)

In March, I launched InsideOrchard.com as a home to my unique perspective on technology and its impact on society. Over the past nine months, 40 essays and corresponding podcast episodes were published. Although distinct from the analysis and discussion found with Above Avalon, the two sites can be thought of as siblings. A bundle consisting of both an Above Avalon membership and Inside Orchard subscription, with an accompanying price discount, was purchased by a good percentage of the Above Avalon member base.

Here’s to 2022

A big thank you goes out to readers, listeners, and members for making 2021 another successful year for Above Avalon. Have a safe and relaxing Christmas, holiday season, and New Year. See you in 2022. - Neil

Above Avalon Podcast Episode 179: Winning the Buyback Debate

After years of criticism, doubt, and questions surrounding Apple’s share buyback program, we are at a point where we can say with confidence that the buyback debate has ended and Apple was declared the winner. In episode 179, Neil goes over how the buyback debate began and why so many people underestimated Apple’s ability to both buy back shares and invest in its future at the same time.

To listen to episode 179, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Apple Won the Share Buyback Debate

I receive many questions about Apple from Above Avalon readers, listeners, and members. In previous years, one topic has been far ahead of any other as a source of questions. Everyone wanted to know about Apple’s share buyback program.

Why is Apple buying back its shares?

Is Tim Cook trying to take Apple private?

Does buying back shares signal anything about Apple’s future product plans?

Why doesn’t Apple use cash to buy larger companies instead of buying back its shares?

Something interesting happened in 2020. I received far fewer questions about Apple’s share buyback program. To be precise, I didn’t receive an incoming question about buyback in nine months - from when the stock market put in a bottom in April 2020 to the start of 2021. What explains such a dramatic change? The Apple share buyback debate ended, and Apple was declared the winner.

How It Started

In the early 2010s, many on Wall Street viewed Apple as the iPhone company, and the iPhone was said to be “dead in the water.” A few activist hedge funds began circling around Apple shares due to their low valuation metrics relative to peers and the overall market. Apple was trading at a single digit forward price-to-earnings multiple – a valuation typically afforded to companies with little to no growth potential. On a free cash flow yield basis, Apple was priced like a junk bond.

In March 2012, after consultation with top shareholders, Apple announced it would begin paying a quarterly cash dividend and buying back shares. While Wall Street mostly applauded the move, Silicon Valley was convinced Apple had made a big mistake. Some thought Tim Cook was pressured into buying back Apple shares. Those who followed the “what would Steve Jobs do” doctrine were convinced that Cook had placed Apple on a path to ruin since Steve Jobs had famously viewed dividends and buyback as nothing more than distractions. At the time, none of Apple’s high-growth peers were buying back shares, which made Apple look even more like an outlier.

The primary concern held by those skeptical of Apple buying back shares was that by using cash to repurchase shares, Apple would have less cash to spend on capital expenditures (capex), research & development (R&D), and mergers & acquisitions (M&A). Said another way, some thought Apple was sacrificing its growth potential just to buy back shares.

Repurchase Pace

When looking back at Apple’s share buyback activity, one event stands out: passage of the Tax Cuts and Jobs Act of 2017. Prior to U.S. tax reform, Apple was constrained in terms of the amount of cash that could be spent on buyback. The company was penalized for bringing foreign cash back to the U.S. to fund share buyback. As shown in the exhibit below, Apple kept share buyback to a $30 billion to $45 billion per year pace despite having more than $150 billion of net cash on the balance sheet. Following U.S. tax reform, Apple was able to repatriate its foreign cash at more attractive tax rates. Apple’s share buyback pace shot higher and has been trending at $70 billion per year.

Exhibit 1: Apple Share Buyback Pace (Annual - FY)

Judging Apple’s Buyback Program

Since beginning to repurchase shares in 2013, Apple has spent $380 billion to buy back 10.6 billion shares at an average price of $35.80 per share. It’s tempting to think that Apple’s share buyback has been a success because Apple shares are trading 265% higher than the average price management paid to repurchase shares. However, one cannot judge buyback’s effectiveness or success by merely looking at the current stock price. Apple retires repurchased shares so there aren’t unrealized gains on the balance sheet from previously repurchased shares.

Share repurchases aren’t meant to boost stock prices even though some management teams may strive for such an outcome. Instead, share buyback is a tool for removing excess cash from balance sheets. In the process, a wealth transfer event is possible as ownership is shifted from shareholders willing to sell shares back to the company to those shareholders not selling shares. This is one reason why share buybacks are not created equally. Some companies incorrectly think buyback is a way to solve a problematic business model or lack of future growth while other companies see share buyback as a tool for balance sheet optimization.

The Above Avalon Report, “Share Buyback 101: An Examination of Apple’s Share Repurchase Strategy” contains much more detail on the wealth transfer dynamic found with share buyback. The report is available exclusively to Above Avalon members.

By repurchasing shares, a company doesn’t face brighter future prospects or even a higher stock price. The list of companies with stock prices that declined precipitously once share buyback concluded is long. Accordingly, a share buyback program’s effectiveness cannot and should not be judged by a company’s stock price.

End of Debate

Consensus agreed that Apple was holding on to too much cash on the balance sheet. However, there were differing opinions as to what Apple should do to remove the excess cash. Some thought that Apple should go on an M&A shopping spree. Twitter? Apple should buy it. Tesla? Apple should buy it. Netflix? Apple should buy it. Others thought Apple should ramp R&D so that as a percent of revenue, its R&D spending would be in line with that of its peers.

Instead of pursuing questionable expenditures such as large-scale M&A, paying special dividends, or simply saying “yes” to every R&D project imaginable, Apple instead saw an opportunity to both manage its balance sheet to a net cash neutral position (the amount of cash equals the amount of debt) and simultaneously invest in its future.

Apple’s share buyback debate didn’t end because Apple shares traded above a certain level, Apple repurchased shares below intrinsic value, or the company’s cash levels declined below a certain threshold. Instead, the buyback debate ended because Apple was able to successfully demonstrate that it can pile cash into buyback at record levels while also investing in its future at the same time. With Apple’s share buyback pace remaining at record levels, the company has been able to ramp up R&D to record levels while continuing to fund capex and pursue intelligent M&A.

What Did People Get Wrong?

Why did so many people underestimate Apple’s ability to both buy back shares and invest in its future at the same time?

People overestimated the amount of cash Apple actually needed to run the business and invest in the future.

People underestimated Apple’s ability to generate free cash flow.

As a percent of revenue, Apple’s R&D has historically been lower than that of its peers. Instead of this reflecting Apple underinvesting in R&D, the lower percentage reflects Apple’s unique culture and approach to product development. A better approach to take when judging Apple’s R&D spending is to compare current expenditures to historical totals. Apple spent more on R&D in FY2020 than the total it spent on R&D cumulatively from FY2010 to FY2014.

Apple’s capex needs are less than those of its peers. Apple has a capex-light business model because the company doesn’t offer free services to billions of people with a monetization strategy revolving around ads. This results in less property, plant, and equipment requirements.

Turning to M&A, Apple isn’t interested in buying products and users – a strategy that would likely be met with failure given the difficulty found with assimilating a target’s culture. Instead, Apple uses M&A to fill asset holes in the form of accessing technology and talent. This lends itself to Apple pursuing smaller deals involving companies with less in the way of thriving business models (and premium price tags).

Based on my estimates, Apple requires $10 billion to $15 billion per year to maintain and invest in property, plant, and equipment, and pursue intelligent M&A. Meanwhile, Apple’s business model predisposes the company to superior free cash flow generation. In FY2020, Apple generated a whopping $71 billion of free cash flow. The lack of significant capex requirements means that a high percentage of its operating cash flow ends up being free cash flow. As shown in Exhibit 2, Apple’s free cash flow has been increasing over time.

Exhibit 2: Apple Free Cash Flow (Annual - FY)

Apple’s superior free cash flow generation, combined with its investment run rate, allows the company to return tens of billions of dollars of excess cash to shareholders each year. This isn’t cash that would have been better suited for more R&D, capex, or M&A. Instead, the cash spent on buyback ends up keeping Apple management more disciplined and focused on proper and intelligent spending.

Big Picture

Apple has become a leader in corporate finance strategy. Following Apple, Google, Facebook, and Amazon have each subsequently announced their own share buyback program. Not surprisingly, none of them faced the kind of pushback that Apple faced during the last decade with its own buyback. Instead, Apple peers were applauded.

Consensus was convinced that Apple was buying back shares at the expense of its future growth potential. In reality, Apple’s growth potential has improved as its well-funded product strategy has allowed the company to pull away with the competition. In just the past five years, Apple has grown the iPhone installed base from 570 million to a billion users, and Apple’s ecosystem growth momentum is building. Apple’s wearables business has grown to the size of a Fortune 130 firm. Apple’s Services business went from a $20 billion to a $54 billion annual revenue run rate. In FY2020, Apple’s non-iPhone revenue growth, one of the best measures of ecosystem expansion, was 16%. Once consumers enter the Apple ecosystem via the iPhone, they proceed to buy additional Apple products and services.

There are still some questions worth asking regarding Apple’s share buyback. For example, with Apple shares trading at premium valuation multiples to the market, what is management’s approach to the buyback pace? However, when it’s a question of whether or not Apple management can buy back shares while also investing in its future, the debate has ended and Apple was declared the winner.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from January 14th.

Above Avalon Year in Review (2020)

Heading into 2020, the big question facing Apple was found with growth. Apple had reached a billion users. Would Apple be able to reach two billion users in the 2020s by continuing to do what it had been doing or would more in the way of strategy shifts be needed?

As it did with every company, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. The company needed to figure out a way to continue product development on a global scale with little to no employee travel. Apple retail needed to be completely rethought as social distancing initiatives ruled out the usual crowded Apple stores. Apple events (both WWDC and product unveilings) needed to go virtual.

According to my estimate, Apple saw approximately $20 billion of delayed demand in FY2020 as a result of the pandemic. Approximately 15 million iPhone upgrades were delayed while wearables sales faced pressure due to retail stores being closed. Partially offsetting those headwinds, iPad and Mac results have been stellar as consumers upgrade older machines and look for larger displays to support working at home and distance learning.

Articles

In 2020, I published 15 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s improving competitiveness in comparison to that of its peers and the steps the company is taking to position itself for continued ecosystem growth in the 2020s.

Here are some of my favorite articles published in 2020 (in no particular order):

Apple Is Pulling Away from the Competition. Relying on an obsession with the user experience, Apple is removing oxygen from every market that it plays in. At the same time, the tech landscape is riddled with increasingly bad bets, indifference, and a lack of vision. Apple is pulling away from the competition to a degree that we haven’t ever seen before.

The Secret to Apple's Ecosystem. Apple’s ecosystem remains misunderstood. There is still much unknown as to what makes the ecosystem tick. From what does Apple’s ecosystem derive its power? Why do loyalty and satisfaction rates increase as customers move deeper into the ecosystem? Apple’s ecosystem ends up being about more than just a collection of devices or services. Apple has been quietly building something much larger, and it’s still flying under the radar.

A Billion iPhone Users. A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

Apple’s $460 Billion Stock Buyback. Share buybacks came under fire earlier this year. Some companies that were recent buyers of their shares found themselves in financial distress and seeking bailouts due to economic fallout from the pandemic. A very good argument can be made that Apple has become the poster child of responsible share repurchases. The company has relied on its stellar free cash flow to fund share repurchases over the years.

Apple Watch and a Paradigm Shift in Computing. Despite being only four years old, the Apple Watch has fundamentally changed the way we use technology. Many tech analysts and pundits continue to look at the Apple Watch as nothing more than an iPhone accessory - an extension of the smartphone that will never have the means or capability of being revolutionary. Such a view is misplaced as it ignores how the Apple Watch has already ushered in a paradigm shift in computing.

The five most popular Above Avalon articles in 2020, as measured by page views, were identical to my favorites list.

Podcast Episodes

There were 16 episodes of the Above Avalon podcast recorded and published in 2020, totaling seven hours. The podcast episodes that correspond to my favorite articles are found below:

Charts

The following charts found in Above Avalon articles were among my favorite published in 2020.

Number of Users

While Apple new user growth rates have slowed, the company is still bringing tens of millions of users into the fold. Due to Apple’s views regarding innovation and its focus on the user experience, once someone enters the Apple ecosystem, odds are good that customer will remain in the ecosystem.

Apple Installed Base (Number of Users)

Apple Non-iPhone Revenue Growth

Apple finds itself in an ecosystem expansion phase. Hundreds of millions of people with only one Apple device, an iPhone, are embarking on a search for more Apple experiences. We see this with non-iPhone revenue growing by double digits in the back half of 2020 on a TTM basis, which is higher than growth rates seen in the mid-2010s.

Apple Non-iPhone Revenue Growth Projection

The Apple Innovation Feedback Loop

With Apple Silicon, Apple took lessons learned from personal devices such as Apple Watches, iPhones, and iPads to help push less personal devices, like the Mac, forward.

Daily Updates

In 2020, I published 196 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 196 updates are equivalent to seven books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Apple and the Pandemic

When the pandemic began during the first half of the year, there was much unknown as to how a company like Apple would be impacted. It eventually became clear that Apple and its peers were positioned to do OK during the pandemic although new ways of thinking would be needed to navigate working from home and travel restrictions.

Big Tech Gaining Power in the Pandemic, Apple's Source of Power, Former Apple Industrial Designer Starts Speaker Company (May 28, 2020)

New iPhone Production Starting Soon, iPhone Production Estimates, Apple’s HW Solution for Pandemic Travel Restrictions (Sep 8, 2020)

Apple’s Place in a Stay-at-Home Economy, E-Commerce Acceleration, Some iPad and Mac Production Moving to Vietnam (Nov 30, 2020)

The Paid Video Streaming Battle

With Disney+ and Apple TV+ launching in late 2019 and HBO Max and Peacock launching this past May and July, respectively, 2020 turned out to be the legitimate start of the paid video streaming battle. As the true new kid on the block, Apple learned quite a bit about being more than just a distributor of other people’s content.

Apple Wins Ireland Tax Battle, Apple Hints at Apple TV+ Subscriber Total, Apple’s In-House Content Studio (Jul 15, 2020)

Thoughts on Early iPhone Sales, Disney Reorganizes, Disney Is Streaming’s New Poster Child (Oct 19, 2020)

A Video Content Distribution War, Roku and Amazon vs. Peacock and HBO Max, Microsoft Attacks the App Store (Jul 21, 2020)

Apple Sales Mix by Display Size, WarnerMedia’s Huge Movie Announcement, Apple and Movies (Dec 7, 2020)

Pushback Against the App Store

Apple is pulling away from the competition, and the App Store is considered the best (and last) chance for competitors to reshape the mobile industry to their liking. A series of legal and PR battles were waged against the App Store by a handful of smaller app developers and larger Apple competitors.

Tech CEOs Testify in Front of Congress, Congress’s Concern Regarding Apple, Apple’s Trouble Area (Jul 30, 2020)

Epic Games Breaks App Store Guidelines, Epic Games’ Epic Hypocrisy, The App Store’s Future (Aug 17, 2020)

The Coalition for App Fairness, A New Guerrilla Warfare Tactic, The Coalition’s Questionable Website (Sep 29, 2020)

The House Antitrust Report on Big Tech, Massive Holes in the Antitrust Report, Apple’s Response (Oct 8, 2020)

When looking at my daily updates published in 2020, selecting a handful of favorites out of 196 updates was not an easy task. The following updates stood out to me (in no particular order):

Apple’s Organizational Structure, Apple’s Leadership Structure, An Autonomous Apple. We first go over my thoughts on Apple’s functional organizational structure and the difference between a functional and multidivisional structure. The discussion then turns to Apple leadership and the ideas of “discretionary leadership” and “experts leading experts.” The update concludes with a revisiting of my Above Avalon article, “Jony Ive, Jeff Williams, and a Larger Apple” and a discussion of how Apple has been able to become a larger design company. (Oct 26, 2020)

Nike Earnings, The Similarity Between Nike and Apple, A Stronger Apple and Nike Partnership. We kick off this update with my thoughts on Nike’s earnings. After going over three structural tailwinds facing Nike, we discuss why I think Nike is pulling away from the competition. The discussion then turns to how Nike is the company most like Apple. The update concludes with a look at how Apple and Nike are both interested in health. We go over the competitive dynamic between the two companies and why it’s premature to conclude that Apple and Nike will become fierce competitors in the future. (Sept 24, 2020)

iPhone Momentum Building in Europe, Apple's Good Timing with iPhone SE, Selling Utility on the Wrist. We begin this update with my thoughts on the iPhone gaining momentum in Europe. The discussion includes new iPhone sales share data and what looks to be some kind of inflection point in the region. We also discuss the possible factors behind the inflection point. The update then turns to how Apple ended up launching the updated iPhone SE at just the right time. We then take a closer look at wearables competition on the wrist. In particular, we go over Fitbit’s latest earnings and compare fitness tracker and smartwatch demand. The discussion concludes with why Amazon Halo faces an uphill battle for wrist real estate. (Sep 3, 2020)

Valuing Big Tech on Free Cash Flow, AAPL vs. Free Cash Flow, AAPL vs. Low Interest Rates. This update begins with my thoughts on the idea that Wall Street has changed the way it is valuing Apple - one away from focusing on P/E ratios (price-to-earnings) and more towards free cash flow valuation. After going over the free cash flow yields for the tech giants, we look specifically at Apple’s declining free cash flow yield and what it tells us about how the market is approaching the company. The update concludes with a discussion of interest rates, inflation, and the U.S. Fed looking to embrace elevated inflation before seeing the need for higher rates. There are various AAPL-related implications associated with that development. (Aug 25, 2020)

Apple Acquires NextVR, Apple Glasses in 2022?, A Wearables Platform for the Face. We begin this update with my thoughts on Apple acquiring NextVR. The discussion includes the reasons why I think Apple acquired NextVR and how the company can play a role in Apple’s product strategy. The update then turns to new rumors about Apple Glasses launch dates. Simply put, the Apple AR / VR rumor mill is getting out of hand. We go over two factors that I think are driving the varied rumors regarding Apple Glasses. The discussion concludes with a different way of thinking about AR / VR and Apple. (May 18, 2020)

Warren Buffett’s Annual Letter, The Power of Apple Retained Earnings, Imploding Demand for Fitbit. We kick off this update by examining Warren Buffett’s annual letter to Berkshire Hathaway shareholders. Berkshire Hathaway is Apple’s largest individual shareholder. Accordingly, there is value in keeping on top of Berkshire and Warren Buffett (Berkshire’s CEO and Chairman of the Board). The discussion then turns to retained earnings and why Apple’s retained earnings are such a powerful tool. We conclude with a look at Fitbit’s awful 4Q19 earnings and why the company represents such a problem for Google. (Feb 24, 2020)

Here are the five most popular daily updates published in 2020 based on page views:

iPhone Sales Share Rises During Pandemic, It’s All About Smartphone Upgrading, A $5,000 Swiss Smartwatch (Jun 3, 2020)

Google Pixel Shakeup, Consumer Spending During the Pandemic, Surface Sales vs. iPad and Mac Sales (May 14, 2020)

Apple vs. Hey (Jun 17, 2020)

The App Store’s Impact on Apple Financials, Facebook Launches Paid Online Events, 4Q20 Microsoft Surface Results (Aug 18, 2020)

Just 11% of the daily updates published in 2020 are highlighted above. The full archive consisting of all 196 daily updates is available here. Membership is required to access the updates.

Daily Podcast (Launched in 2020)

In 2020, Above Avalon Daily Updates became available in audio for the first time via a private podcast called Above Avalon Daily. Reception to the daily podcast continues to exceed my expectations with very positive listener feedback. The podcast has allowed members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. More information on the daily podcast, including a few sample episodes, is found here. Above Avalon Daily was launched in August, and 66 episodes were published in 2020, totaling nearly 17 hours of audio. Once a member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Here’s to 2021

Without question, 2020 ended up being the busiest year for Apple since Above Avalon was launched in 2014. There was no shortage of newsworthy stories, and all indicators point to the fast pace continuing into 2021. A big thank you goes out to Above Avalon readers, listeners, and members for making 2020 another successful year for Above Avalon.

Above Avalon Podcast Episode 167: A Stock Buyback Poster Child

Share buyback is one of a handful of tools that boards and management teams have to properly manage balance sheets. However, economic fallout related to the pandemic has led to a new round of criticism aimed at buyback. In episode 167, Neil discusses how Apple has become the poster child of responsible share repurchases. Additional topics include: Apple’s recent stock buyback activity, Neil’s expectation for Apple’s upcoming update to its buyback program, the latest criticism surrounding buyback, repurchasing shares in a pandemic, and the harsh reality found with stock buybacks.

To listen to episode 167, go here.

The complete Above Avalon podcast episode archive is available here.

Apple's $460 Billion Stock Buyback

Share buybacks have once again come under fire. Some companies that were recent buyers of their shares now find themselves in financial distress and seeking bailouts due to economic fallout from the pandemic. Set within this environment and backlash, Apple is scheduled to provide an update next week on its capital return program, including its share buyback program. The announcement will provide clues for how the poster child of responsible share repurchases is financially navigating the pandemic.

Buyback Pace

Since kicking off its repurchase program in 2013, Apple has spent $327 billion to buy back 2.5 billion shares at an average price of $131 per share. The following exhibit shows Apple’s buyback activity on an annual basis:

Exhibit 1: Apple Share Buyback Pace (Annual - FY)

The pickup in Apple’s buyback pace in FY2018 and FY2019 was due to U.S. tax reform and Apple utilizing cash that had been in non-U.S. subsidiaries. Last year, Apple spent $55 billion buying back 283 million shares (at an $194 average price) in open market transactions. Adding this total to $12B of accelerated share repurchases, Apple spent a total of $67 billion on share buyback. To put that total in perspective, it’s more than the market capitalization of 85% of the companies in the S&P 500.

Buyback Authorization

Every April, Apple’s board of directors, in consultation with management, assesses business trends, the operating environment, and Apple’s financial position, to arrive at an appropriate level of capital return (share repurchases and quarterly cash dividends).

The board has authorized seven consecutive increases to Apple’s share buyback program since the program launched in 2012:

2012: $10 billion buyback authorization

2013: $60 billion (increase of $50 billion)

2014: $90 billion (increase of $30 billion)

2015: $140 billion (increase of $50 billion)

2016: $175 billion (increase of $35 billion)

2017: $210 billion (increase of $35 billion)

2018: $310 billion (increase of $100 billion)

2019: $385 billion (increase of $75 billion)

At the end of December 2019, Apple had $59 billion of share repurchase authorization remaining. Assuming Apple bought back at least $10 billion of shares in FY2Q20 (January to March 2020), the company likely had somewhere closer to $50 billion of authorization remaining at the end of March. This means that without additional authorization, Apple would have about seven months worth of share repurchases remaining. Accordingly, there is a strong likelihood of Apple’s board announcing the eight consecutive increase in share repurchase authorization next week.

My expectation is for Apple’s board to announce a $75 billion increase to buyback authorization next week. This would allow Apple to continue buying back shares at the same pace that it has for the past 24 months. Such an authorization would bring Apple’s total repurchase authorization since 2012 to $460 billion. In order to add flexibility to such authorization, especially given the current environment, Apple will likely have more than 12 months to utilize the authorization. This means that if operating conditions continue to deteriorate over the next 12 months, Apple will have the ability to slow down its share buyback pace and run with a higher level of untapped repurchase authorization.

Although companies are not under obligation to utilize share repurchase authorization, Apple has approached its authorization differently. Many companies announce a new share buyback program in order to benefit from the near-term stock price bump often associated with the announcement. These companies never actually intend to utilize the full buyback authorization. Meanwhile, Apple has been an aggressive repurchaser of its shares, which require material increases in buyback authorization every year.

Buyback Criticism

In recent weeks, share buyback has once again been put under a microscope. The act of taking cash on the balance sheet to buy back shares from shareholders willing to sell is no stranger to criticism. Prior to the pandemic, the most recent uproar regarding buyback occurred during the U.S. tax reform debate as some felt it wasn’t right for companies to use repatriated cash to repurchase shares (and pay cash dividends).

With passenger airline travel coming to a near halt, the airliners find themselves in a dire financial situation. Delta is burning through $60 million of cash a day. The airlines were quick to seek U.S. taxpayer-funded bailouts in the form of grants and loans. The entire episode has left a bad taste in many mouths as the airlines had been aggressive share repurchasers. Instead of establishing some kind of rainy day fund, the airlines used free cash flow to fund share repurchases at prices significantly higher than current stock prices.

Past financial crises have also provided examples of share buyback gone wrong. Some insurers who were busy buying back their shares in 2007 ended up needing to issue shares at significant discounts not long after due to holding toxic mortgage investments. The gas and energy industry turned to share repurchases when oil was at $100 a barrel.

With each example, we have boards and management teams who felt it was prudent in good economic times to buy back their shares. It’s fair to ask if some of these companies used share buyback primarily to hide financial and business shortcomings elsewhere. Bad actors can utilize share buyback for near-term manipulation either through improper signaling to the market or financial engineering. Reducing the number of shares outstanding via buyback results in higher earnings per share figures and return on equity percentages, all else equal.

The Poster Child

And then there is Apple. A very good argument can be made that Apple has become the poster child of responsible share repurchases. The company has relied on its stellar free cash flow to fund share repurchases over the years. Prior to U.S. tax reform and Apple keeping cash generated outside the U.S. in foreign subsidiaries, Apple issued debt at roughly the same pace as foreign cash generation. This resulted in Apple having $285 billion of cash, cash equivalents, and marketable securities on the balance sheet at the end of 1Q18. After two years of aggressive share repurchases, Apple’s cash total is now closer to $200 billion.

By funding buyback with free cash flow, share repurchases have had zero impact on the amount of cash Apple wants to spend on organic growth initiatives including R&D, M&A, and capital expenditures. Apple is using truly excess cash that it has no use for to repurchase its shares.

Partly to provide a buffer against adverse market conditions and to retain M&A flexibility, Apple is following a net cash neutral strategy which means that the amount of cash held on the balance sheet will eventually equal the amount of outstanding debt. Given Apple’s current debt holdings, this amounts to holding approximately a $100 billion cash cushion in the event of a rainy day. On top of that, given Apple’s unique capex-light business model, the company is able to generate tens of billions of dollars of free cash flow each year even with lower sales due to a global recession.

Since share buyback makes financial sense when repurchases are done at a share price that is less than a company’s intrinsic value, it is much harder to assess a buyback’s effectiveness, or the amount wealth transferred between shareholders selling and holding shares.

The Above Avalon Report, “Share Buyback 101: An Examination of Apple’s Share Repurchase Strategy” contains much more detail on the wealth transfer dynamic found with share buyback. The report is available exclusively to Above Avalon members.

In theory, management teams are in the best position to estimate their company’s intrinsic value. However, it’s easy to see hubris enter the situation with management teams overestimating their strengths while ignoring or downplaying weaknesses and risks. Since Apple is a design company tasked with making tools for people, having an inside view of the product pipeline plays a major role in estimating Apple’s intrinsic value. This may end up giving Apple management an advantage when it comes to assessing buyback’s effectiveness.

Buybacks and the Pandemic

The pandemic has changed the buyback discussion for every public company. Using Apple as an example, it’s not that the company’s intrinsic value, which reflects Apple’s cash flow generating capability in the future, has changed because of economic fallout related to the pandemic. Instead, market dislocations in credit markets have led to a renewed focus on liquidity and balance sheet preservation.

Apple has shown the willingness in the past to pause share repurchases based on adverse market trends. It is possible that Apple paused the buyback last month while credit markets were acting abnormal or the situation in China didn’t bode well for the rest of the world. However, given its stellar balance sheet, there likely is no company in a better position than Apple to buy back shares during a pandemic.

Harsh Reality

The harsh reality found with share buyback is that not every company should buy back their shares. While we can debate just how much of a financial cushion a company should keep in case of a pandemic or natural disaster, it’s much easier to say that overextending a balance sheet in order to buy back shares is unwise.

As the airline industry shows us, additional considerations that should be prioritized when assessing a share repurchase program are the company’s business model, ability to access capital in adverse market conditions, and difference between share price and intrinsic value. A company’s intrinsic value should reflect the sustainability, or lack thereof, of the future cash flow stream.

Share buyback is one of a handful of tools that boards and management teams have to properly manage balance sheets. While some companies have no purpose using the tool, others can benefit immensely from the same tool. Instead of simply casting off share repurchases as ineffective, inappropriate, or even dangerous, attention should go to assessing how a company is using share buyback.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 146: Tackling Apple's Excess Cash

In what has become an annual trend, Apple uses FY2Q earnings to also update its share buyback authorization and quarterly cash dividend. In episode 146, we preview the changes Apple will likely announce to its capital return program. The discussion begins by going over how Apple has adjusted its buyback pace following U.S. tax reform and why the company will eventually have to cut back on buyback. We then go over my expectations for what Apple’s board will approve in terms of increases to the buyback authorization and quarterly cash dividend. Additional topics include the debate surrounding Apple capital return and why the company has so few viable options for spending excess cash.

To listen to episode 146, go here.

The complete Above Avalon podcast episode archive is available here.