Apple 1Q25 Earnings Review Wrap-Up (Management Remarks, 10-Q Notes, Buyback Tidbits, Paid Subscription Tally)

Today's Above Avalon Daily email contains the following story:

Apple 1Q25 Earnings Review Wrap-Up (Management Remarks, 10-Q Notes, Buyback Tidbits, Paid Subscription Tally)

We wrap up our Apple 1Q25 earnings review. In yesterday’s update, our focus was on Apple’s 1Q25 earnings call Q&A exchanges. There were a few remaining comments worth going over regarding management’s prepared remarks prior to the Q&A. We then turn to Apple’s 1Q25 10-Q. Published at the end of FY1Q, 2Q, and 3Q, 10-Q filings provide additional commentary and disclosures regarding a company's business and financial results. For the 1Q25 10-Q, my focus was on qualitative descriptions for Apple's financial performance. The update concludes with examinations into Apple’s latest share buyback activity and the number of paid subscriptions.

Become a member to continue reading today’s update. Already a member? Read the full update here.

An audio version of this update is available to members who have the podcast add-on attached to their membership.

Member Privileges and Benefits

Become an Above Avalon member and receive the following privileges and benefits:

Exclusive Analysis. Receive the Above Avalon Daily newsletter, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year.

Archive Access. Access previous newsletters sent to members.

Member Forum Access. Access all channels in the Above Avalon forum in Discord.

Email Access. Receive timely responses from Neil to email inquiries.

Access to Add-ons. Customize a membership with the Podcast, Inside Orchard, and Financial Models add-ons.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent voice and resource.

Apple’s Installed Base Growth, Apple's Paid Subscriptions Growth, A More Effective Apple Growth Narrative for Wall Street

Last Friday’s update kicked off our Apple 1Q24 earnings review. When it comes to Apple’s financial story, trends are tracking close to Neil’s expectations. For today, we will take a closer look at one takeaway from earnings: Apple’s ecosystem growth.

An Above Avalon membership is required to read this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time.

An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-on.

Above Avalon Year in Review (2020)

Heading into 2020, the big question facing Apple was found with growth. Apple had reached a billion users. Would Apple be able to reach two billion users in the 2020s by continuing to do what it had been doing or would more in the way of strategy shifts be needed?

As it did with every company, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. The company needed to figure out a way to continue product development on a global scale with little to no employee travel. Apple retail needed to be completely rethought as social distancing initiatives ruled out the usual crowded Apple stores. Apple events (both WWDC and product unveilings) needed to go virtual.

According to my estimate, Apple saw approximately $20 billion of delayed demand in FY2020 as a result of the pandemic. Approximately 15 million iPhone upgrades were delayed while wearables sales faced pressure due to retail stores being closed. Partially offsetting those headwinds, iPad and Mac results have been stellar as consumers upgrade older machines and look for larger displays to support working at home and distance learning.

Articles

In 2020, I published 15 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s improving competitiveness in comparison to that of its peers and the steps the company is taking to position itself for continued ecosystem growth in the 2020s.

Here are some of my favorite articles published in 2020 (in no particular order):

Apple Is Pulling Away from the Competition. Relying on an obsession with the user experience, Apple is removing oxygen from every market that it plays in. At the same time, the tech landscape is riddled with increasingly bad bets, indifference, and a lack of vision. Apple is pulling away from the competition to a degree that we haven’t ever seen before.

The Secret to Apple's Ecosystem. Apple’s ecosystem remains misunderstood. There is still much unknown as to what makes the ecosystem tick. From what does Apple’s ecosystem derive its power? Why do loyalty and satisfaction rates increase as customers move deeper into the ecosystem? Apple’s ecosystem ends up being about more than just a collection of devices or services. Apple has been quietly building something much larger, and it’s still flying under the radar.

A Billion iPhone Users. A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

Apple’s $460 Billion Stock Buyback. Share buybacks came under fire earlier this year. Some companies that were recent buyers of their shares found themselves in financial distress and seeking bailouts due to economic fallout from the pandemic. A very good argument can be made that Apple has become the poster child of responsible share repurchases. The company has relied on its stellar free cash flow to fund share repurchases over the years.

Apple Watch and a Paradigm Shift in Computing. Despite being only four years old, the Apple Watch has fundamentally changed the way we use technology. Many tech analysts and pundits continue to look at the Apple Watch as nothing more than an iPhone accessory - an extension of the smartphone that will never have the means or capability of being revolutionary. Such a view is misplaced as it ignores how the Apple Watch has already ushered in a paradigm shift in computing.

The five most popular Above Avalon articles in 2020, as measured by page views, were identical to my favorites list.

Podcast Episodes

There were 16 episodes of the Above Avalon podcast recorded and published in 2020, totaling seven hours. The podcast episodes that correspond to my favorite articles are found below:

Charts

The following charts found in Above Avalon articles were among my favorite published in 2020.

Number of Users

While Apple new user growth rates have slowed, the company is still bringing tens of millions of users into the fold. Due to Apple’s views regarding innovation and its focus on the user experience, once someone enters the Apple ecosystem, odds are good that customer will remain in the ecosystem.

Apple Installed Base (Number of Users)

Apple Non-iPhone Revenue Growth

Apple finds itself in an ecosystem expansion phase. Hundreds of millions of people with only one Apple device, an iPhone, are embarking on a search for more Apple experiences. We see this with non-iPhone revenue growing by double digits in the back half of 2020 on a TTM basis, which is higher than growth rates seen in the mid-2010s.

Apple Non-iPhone Revenue Growth Projection

The Apple Innovation Feedback Loop

With Apple Silicon, Apple took lessons learned from personal devices such as Apple Watches, iPhones, and iPads to help push less personal devices, like the Mac, forward.

Daily Updates

In 2020, I published 196 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 196 updates are equivalent to seven books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Apple and the Pandemic

When the pandemic began during the first half of the year, there was much unknown as to how a company like Apple would be impacted. It eventually became clear that Apple and its peers were positioned to do OK during the pandemic although new ways of thinking would be needed to navigate working from home and travel restrictions.

Big Tech Gaining Power in the Pandemic, Apple's Source of Power, Former Apple Industrial Designer Starts Speaker Company (May 28, 2020)

New iPhone Production Starting Soon, iPhone Production Estimates, Apple’s HW Solution for Pandemic Travel Restrictions (Sep 8, 2020)

Apple’s Place in a Stay-at-Home Economy, E-Commerce Acceleration, Some iPad and Mac Production Moving to Vietnam (Nov 30, 2020)

The Paid Video Streaming Battle

With Disney+ and Apple TV+ launching in late 2019 and HBO Max and Peacock launching this past May and July, respectively, 2020 turned out to be the legitimate start of the paid video streaming battle. As the true new kid on the block, Apple learned quite a bit about being more than just a distributor of other people’s content.

Apple Wins Ireland Tax Battle, Apple Hints at Apple TV+ Subscriber Total, Apple’s In-House Content Studio (Jul 15, 2020)

Thoughts on Early iPhone Sales, Disney Reorganizes, Disney Is Streaming’s New Poster Child (Oct 19, 2020)

A Video Content Distribution War, Roku and Amazon vs. Peacock and HBO Max, Microsoft Attacks the App Store (Jul 21, 2020)

Apple Sales Mix by Display Size, WarnerMedia’s Huge Movie Announcement, Apple and Movies (Dec 7, 2020)

Pushback Against the App Store

Apple is pulling away from the competition, and the App Store is considered the best (and last) chance for competitors to reshape the mobile industry to their liking. A series of legal and PR battles were waged against the App Store by a handful of smaller app developers and larger Apple competitors.

Tech CEOs Testify in Front of Congress, Congress’s Concern Regarding Apple, Apple’s Trouble Area (Jul 30, 2020)

Epic Games Breaks App Store Guidelines, Epic Games’ Epic Hypocrisy, The App Store’s Future (Aug 17, 2020)

The Coalition for App Fairness, A New Guerrilla Warfare Tactic, The Coalition’s Questionable Website (Sep 29, 2020)

The House Antitrust Report on Big Tech, Massive Holes in the Antitrust Report, Apple’s Response (Oct 8, 2020)

When looking at my daily updates published in 2020, selecting a handful of favorites out of 196 updates was not an easy task. The following updates stood out to me (in no particular order):

Apple’s Organizational Structure, Apple’s Leadership Structure, An Autonomous Apple. We first go over my thoughts on Apple’s functional organizational structure and the difference between a functional and multidivisional structure. The discussion then turns to Apple leadership and the ideas of “discretionary leadership” and “experts leading experts.” The update concludes with a revisiting of my Above Avalon article, “Jony Ive, Jeff Williams, and a Larger Apple” and a discussion of how Apple has been able to become a larger design company. (Oct 26, 2020)

Nike Earnings, The Similarity Between Nike and Apple, A Stronger Apple and Nike Partnership. We kick off this update with my thoughts on Nike’s earnings. After going over three structural tailwinds facing Nike, we discuss why I think Nike is pulling away from the competition. The discussion then turns to how Nike is the company most like Apple. The update concludes with a look at how Apple and Nike are both interested in health. We go over the competitive dynamic between the two companies and why it’s premature to conclude that Apple and Nike will become fierce competitors in the future. (Sept 24, 2020)

iPhone Momentum Building in Europe, Apple's Good Timing with iPhone SE, Selling Utility on the Wrist. We begin this update with my thoughts on the iPhone gaining momentum in Europe. The discussion includes new iPhone sales share data and what looks to be some kind of inflection point in the region. We also discuss the possible factors behind the inflection point. The update then turns to how Apple ended up launching the updated iPhone SE at just the right time. We then take a closer look at wearables competition on the wrist. In particular, we go over Fitbit’s latest earnings and compare fitness tracker and smartwatch demand. The discussion concludes with why Amazon Halo faces an uphill battle for wrist real estate. (Sep 3, 2020)

Valuing Big Tech on Free Cash Flow, AAPL vs. Free Cash Flow, AAPL vs. Low Interest Rates. This update begins with my thoughts on the idea that Wall Street has changed the way it is valuing Apple - one away from focusing on P/E ratios (price-to-earnings) and more towards free cash flow valuation. After going over the free cash flow yields for the tech giants, we look specifically at Apple’s declining free cash flow yield and what it tells us about how the market is approaching the company. The update concludes with a discussion of interest rates, inflation, and the U.S. Fed looking to embrace elevated inflation before seeing the need for higher rates. There are various AAPL-related implications associated with that development. (Aug 25, 2020)

Apple Acquires NextVR, Apple Glasses in 2022?, A Wearables Platform for the Face. We begin this update with my thoughts on Apple acquiring NextVR. The discussion includes the reasons why I think Apple acquired NextVR and how the company can play a role in Apple’s product strategy. The update then turns to new rumors about Apple Glasses launch dates. Simply put, the Apple AR / VR rumor mill is getting out of hand. We go over two factors that I think are driving the varied rumors regarding Apple Glasses. The discussion concludes with a different way of thinking about AR / VR and Apple. (May 18, 2020)

Warren Buffett’s Annual Letter, The Power of Apple Retained Earnings, Imploding Demand for Fitbit. We kick off this update by examining Warren Buffett’s annual letter to Berkshire Hathaway shareholders. Berkshire Hathaway is Apple’s largest individual shareholder. Accordingly, there is value in keeping on top of Berkshire and Warren Buffett (Berkshire’s CEO and Chairman of the Board). The discussion then turns to retained earnings and why Apple’s retained earnings are such a powerful tool. We conclude with a look at Fitbit’s awful 4Q19 earnings and why the company represents such a problem for Google. (Feb 24, 2020)

Here are the five most popular daily updates published in 2020 based on page views:

iPhone Sales Share Rises During Pandemic, It’s All About Smartphone Upgrading, A $5,000 Swiss Smartwatch (Jun 3, 2020)

Google Pixel Shakeup, Consumer Spending During the Pandemic, Surface Sales vs. iPad and Mac Sales (May 14, 2020)

Apple vs. Hey (Jun 17, 2020)

The App Store’s Impact on Apple Financials, Facebook Launches Paid Online Events, 4Q20 Microsoft Surface Results (Aug 18, 2020)

Just 11% of the daily updates published in 2020 are highlighted above. The full archive consisting of all 196 daily updates is available here. Membership is required to access the updates.

Daily Podcast (Launched in 2020)

In 2020, Above Avalon Daily Updates became available in audio for the first time via a private podcast called Above Avalon Daily. Reception to the daily podcast continues to exceed my expectations with very positive listener feedback. The podcast has allowed members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. More information on the daily podcast, including a few sample episodes, is found here. Above Avalon Daily was launched in August, and 66 episodes were published in 2020, totaling nearly 17 hours of audio. Once a member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Here’s to 2021

Without question, 2020 ended up being the busiest year for Apple since Above Avalon was launched in 2014. There was no shortage of newsworthy stories, and all indicators point to the fast pace continuing into 2021. A big thank you goes out to Above Avalon readers, listeners, and members for making 2020 another successful year for Above Avalon.

Above Avalon Podcast Episode 175: iPhone at a Billion

According to Neil’s estimate, Apple surpassed the billion iPhone users milestone last month. With the iPhone upgrade cycle approaching a plateau of four to five years, Apple is well-positioned to report record iPhone unit sales. In episode 175, Neil discusses the current state of the iPhone business as it surpasses a billion users. Topic include: iPhone unit sales, iPhone sales mix broken out by iPhone upgrades and new users, the iPhone installed base, Apple’s top priorities for iPhone, peak iPhone, and more.

To listen to episode 175, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

A Billion iPhone Users

A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Thirteen years after going on sale, the iPhone remains the perennial most popular and best-selling smartphone. Competitors continue to either shamelessly copy iPhone or, at a minimum, be heavily influenced by the iPhone. Looking ahead, Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

iPhone Sales

Over the past two years, iPhone sales have experienced notable gyrations. In early 2019, Apple saw material weakness in iPhone sales due to deteriorating economic conditions in China related to U.S. trade tensions. Although Tim Cook faced some skepticism when making such a claim, the observation was later proven to be legitimate as a number of other companies went on to describe a similar slowdown in demand.

As shown in Exhibit 1, iPhone unit sales on a trailing twelve months basis dropped by about 12% in early 2019 from a 218 million annual pace to a 191 million pace. The iPhone business went on to experience a gradual improvement in sell-through (i.e. customer) demand during the second half of 2019 and the beginning of 2020 before the pandemic hit. iPhone unit sales are back above a 200 million annual pace and are currently 13% below the unit sales high experienced in 2015.

Exhibit 1: iPhone Unit Sales (TTM Basis)

At a glance, Exhibit 1 would suggest that the iPhone business has lost some of the shine it had in the mid-2010s. However, this would be a misreading of the situation. On its own, unit sales don’t tell us the full story about the iPhone business. This is the primary reason behind Apple’s decision in late 2018 to stop providing unit sales data on a quarterly basis. Wall Street was incorrectly using unit sales as a crutch for shoddy analysis.

Flat to down iPhone unit sales do not automatically mean iPhone business fundamentals have deteriorated. Instead, a longer upgrade cycle can be a leading factor behind declining unit sales. In addition, unit sales don’t say anything about customer loyalty and satisfaction rates, which are crucial when it comes to a customer’s decision to continue using a product.

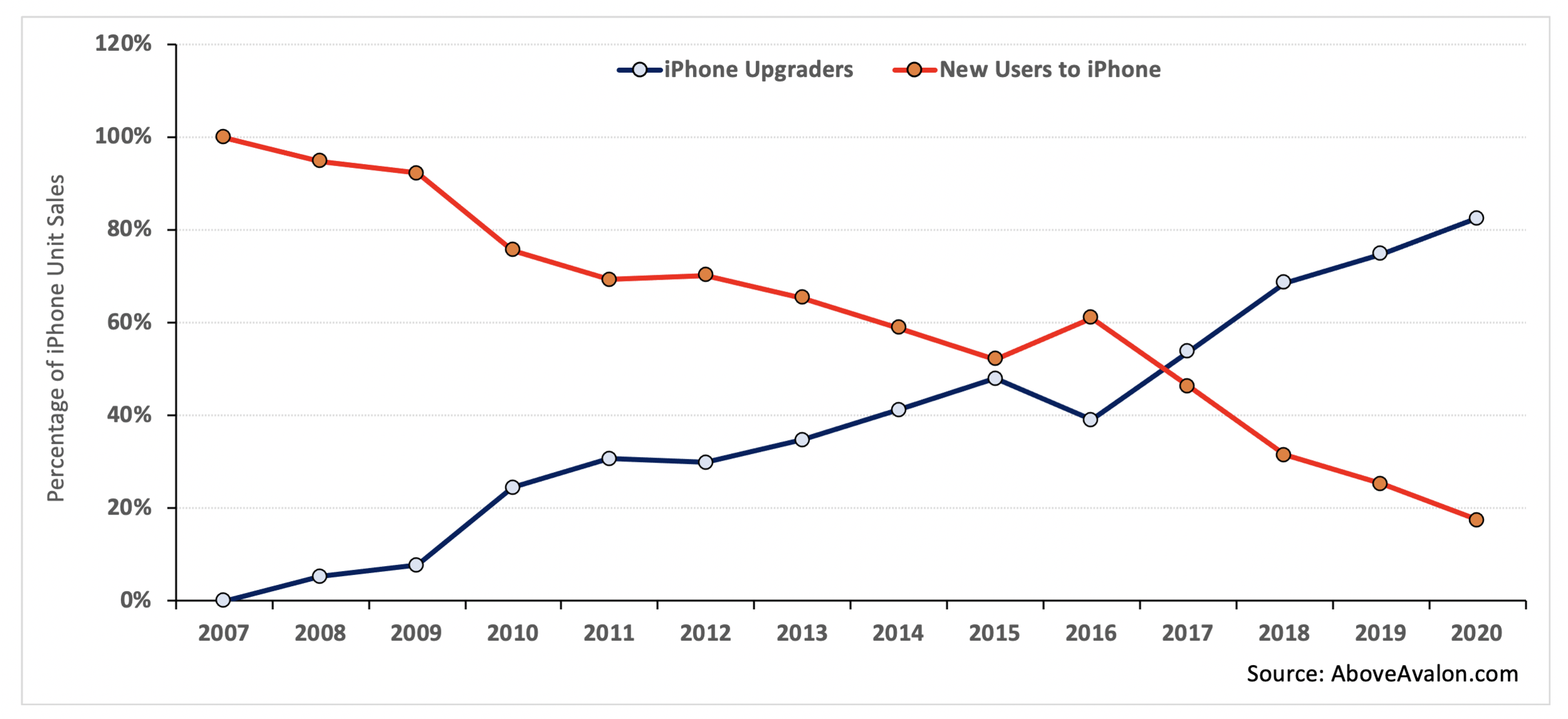

In order to reach more valuable insights regarding the iPhone business, Exhibit 2 takes unit sales data from Exhibit 1 and adds granularity. Instead of looking at sales just in terms of the number of units shipped from a factory, Exhibit 2 takes into account who bought iPhones: customers upgrading to a new iPhone or customers buying their first new iPhone. The data is derived from my iPhone installed base model that tracks when customers entered the installed base and then monitors upgrading patterns.

Exhibit 2: iPhone Unit Sales Mix (iPhone Upgraders vs. New Users to iPhone)

The iPhone business has turned into an upgrading business. While Apple is still bringing in 20M to 30M new iPhone users each year, the percentage of overall iPhone sales going to new users has steadily declined. For FY2020, iPhone sales to new users will likely have accounted for less than 20% of overall iPhone sales - an all-time low.

iPhone Installed Base

While quarterly iPhone unit sales contain an inherent amount of volatility, installed base totals do a better job of monitoring iPhone fundamentals over the long run. The iPhone installed base is defined as the total number of people using an iPhone (both new and used iPhones). A shrinking iPhone installed base would raise a number of warning signs for Apple as it would suggest people have been switching to Android. A growing iPhone installed base would suggest Apple continues to see new users embrace the iPhone for the first time.

Two variables are needed to estimate and track the iPhone installed base:

The number of people who purchase (and continue to use) a new iPhone from Apple or a third-party retailer.

The number of people who are using an iPhone obtained via the gray market. These iPhones have either been passed down through families and friends or resold to new users via a web of retailers and distributors.

By combining the two groups, one is able to derive estimates for the total number of iPhones in the wild. Although Apple does not disclose this installed base figure on a quarterly basis, the company did mention that the iPhone installed base surpassed 900M devices by the end of FY1Q19. As shown in Exhibit 3, which displays my estimates for the Apple installed base over the years, the iPhone installed base has grown each year since launch and recently surpassed a billion people.

(The methodology used to reach my iPhone installed base estimates is available here for Above Avalon members.)

Exhibit 3: iPhone Installed Base (total number of iPhone users in the wild)

In recent years, the pace of growth in the iPhone installed base has slowed. Much of this slower growth is due to high smartphone penetration and Apple having already successfully targeted the premium end of the smartphone market. With that said, Apple is still bringing in approximately 20M to 30M new iPhone users per year. These users are prime candidates for moving deeper into the Apple ecosystem by purchasing other Apple devices and services. Strong growth trends seen with iCloud storage, Apple’s content distribution services, Apple Watch, AirPods, and even iPad / Mac are made possible by hundreds of millions of people moving beyond just an iPhone to own additional Apple services and devices.

iPhone Priorities

Looking ahead, Apple has three primary priorities, or goals, for the iPhone:

Push camera technology boundaries.

Increase the value found with iPhone ownership.

Increase the number of roles handled by the iPhone.

Cameras. When thinking about the iPhone feature that will lead the way over the next five to ten years, more powerful cameras are high on the list. For the past few years, camera improvements and upgrades have been positioned as the top feature found with new flagship iPhones. A similar trend has been found with every major smartphone manufacturer. This has led to a type of camera arms race as each company tries to convince consumers that they have the best camera.

The primary reason Apple and its peers are betting so big on cameras is that they are convinced consumers will find value in smarter “eyes" - cameras that increasingly move into 3D rendering and AR realms. Advances in computational photography are also leveraged to make it easier for people to take really great photos.

While a bet on the camera will turn out to be a good one for Apple, the move doesn’t lack risk. As Apple pushes camera technology forward, many existing iPhone users are content with the iPhone camera they already own. This will manifest itself in no discernible bump in iPhone upgrading simply due to camera upgrades and advancements.

Another factor behind betting big on iPhone camera technology is that the smartphone form factor remains conducive to bringing powerful cameras to the mass market. While a “selfie” camera may make sense on the wrist with Apple Watch, it is difficult to see the wrist as a good place for cameras used to capture memories. There is similar hesitation found with the idea of putting such powerful cameras on the face in the form of AR glasses. Therefore, it makes sense that the device held in our hands and stored in our pockets will likely contain the most powerful camera in our lives.

iPhone Value. A major development regarding the iPhone that continues to fly under the radar is the improving value proposition found with owing and using an iPhone. By improving iPhone durability and longevity, Apple ends up strengthening the iPhone’s value proposition via higher resale values. If a new iPhone can be recirculated to additional users, the gray market will be strengthened and consumers will find more attractive payment terms and options at time of purchase.

An increasing number of iPhone users think about iPhone pricing in terms of monthly payments rather than lump sum. Attractive trade-in offers and payment plans with built-in upgrades only serve to improve the iPhone’s value proposition.

iPhone Roles. Tim Cook kicked off Apple’s “Hi, Speed” product event earlier this month by referring to the iPhone as the product we use the most, every day. He went on to say that the iPhone has never been more indispensable than it is now.

It is in Apple’s best interest to have the iPhone take over an increasing number of roles once given to laptops and desktops in addition to handling entirely new roles. By increasing our dependency on iPhone today, Apple ends up being in a better position to sell various wearable form factors tomorrow. Wearables are designed to not only handle entirely new tasks, but also take over tasks given to the iPhone.

Peak iPhone?

In FY2015, Apple sold 231 million iPhones. There continues to be a debate regarding whether or not Apple experienced “peak iPhone,” never exceeding that 231 million unit sales total in a 12-month stretch.

As a general rule, one needs to approach “peak” sales claims very carefully with Apple products. It may be tempting to look at unit sales data and conclude that a lower sales trend won’t reverse. However, weaker sales may not be the result of a change in market fundamentals such as a permanently reduced addressable market or less capable product. Instead, lower sales may simply reflect a slowdown in upgrading.

Odds are increasing that Apple has not experienced peak iPhone. As shown in Exhibit 4, my FY2021 iPhone unit sales estimate stands at 240M units, 4% higher than Apple’s previous iPhone sales record. My estimate does not assume a mega upgrade cycle kicked off by 5G iPhones. With the iPhone installed base having surpassed a billion users and continuing to expand by 20M to 30M people each year, Apple is in a good position to grow iPhone unit sales as the iPhone upgrade cycle plateaus between four and five years. This is where iPhone’s strong resale value enters the picture with consumers embracing various upgrading plans and options made possible by a well-functioning gray market.

Exhibit 4: iPhone Unit Sales (TTM Basis) - Includes Above Avalon FY2021 Estimates

New User Generation

The iPhone was the largest contributor to Apple growing its overall installed base from 125 million people in 2010 to more than a billion in 2020. Looking ahead, it’s fair to wonder if the iPhone will remain Apple’s primary new user funnel for the next billion users.

A strong case can be made that Apple will continue to rely on the iPhone for new user generation in the near term. While flagship iPhone pricing is aimed at the premium segment of the market, the gray market continues to play its role in expanding the iPhone’s reach to lower price segments.

Apple is also getting that much closer to launching its face wearables strategy. Requiring early versions of face wearables (AR / VR glasses) to work with an iPhone is logical when thinking about the limited amount of space for technology found with a pair of thin and light glasses.

Over time, we can’t ignore the new user growth potential found with Apple wearables. Apple Watch remains on its march to full independency from the iPhone. A truly independent Apple Watch would expand the product’s address market by threefold. AirPods are similarly well-positioned for appealing to Android users around the world. This brings us to India. The country will likely play a crucial role in Apple’s strategy of bringing hundreds of millions of new people into the ecosystem. As wearables make technology more personal, the product category’s addressable market will only expand.

While the iPhone may have been responsible for Apple getting to a billion users, wearables have a decent shot of getting Apple to two billion users.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

Apple's Billion Users

Apple’s ecosystem is massive. Approximately a billion people are using more than 1.4 billion Apple devices. Even as iPhone sales decline, Apple is bringing tens of millions of new people into its ecosystem each year. However, we are getting to a point where it is prudent to begin thinking about what user growth actually means to Apple.

Number of Users

Estimating the total number of Apple users is a relatively straightforward exercise. This past January, Apple disclosed that there were more than 900 million iPhones in the wild. Given that iPhones are not typically shared, Apple’s disclosure implied that there were approximately 900 million people using iPhones. Since the exact number of iPhones in the wild likely now exceeds 925 million, there is some wiggle room in that 900 million user total for the rare instances of people using more than one iPhone.

Apple also disclosed that there were 1.4 billion active devices in the installed base as of January 2019. The total was up by 100 million devices over the preceding 12 months and up by 400 million devices over the preceding three years. This tells us that there are 500 million Apple devices being used that aren’t iPhones. A majority of those 500 million devices are iPads. The Mac represents another 110 million devices, and a collection of wearables and home accessories make up the remaining devices. Given my Mac and iPad installed base estimates, a conservative estimate is that there are at least 100 million people who use either an iPad or Mac but not an iPhone. Adding these 100 million users to the 900 million people with iPhones leads to a billion Apple users.

A billion users is quite the accomplishment for Apple considering how the company does not give away or subsidize hardware. For context, Amazon has approximately 100 million Prime users. Twitter sells a “free” product and has 125 million daily users. A “free” Google service is widely considered a success once it surpasses a billion users. WeChat recently surpassed a billion daily users. Facebook sells a “free” product and has 1.6 billion daily users.

Revenue Per User

Using Apple’s current revenue run rate and my estimate for the total number of users, the company earns on average $258 from every user per year. There are limitations found with relying on averages. Apple’s ecosystem strength is dependent on geography. In addition, other factors like the gray market distort averages. Accordingly, it makes sense to segment Apple’s user base to gain additional insight into revenue per user figures.

There are approximately 200 million Apple users who have never purchased a new product from Apple or a retailer. Instead, these users rely on Apple products acquired or obtained via the gray market. The overall contribution to Apple’s revenue from these users is likely not too great - a few dollars per month, if that.

On the other end of the spectrum, the U.S. represents Apple’s stronghold when it comes to ecosystem strength. Add to hardware revenue various subscriptions such as Apple Music, paid iCloud, and various third-party subscriptions through the App Store. It is not unreasonable to assume that approximately 50 million to 75 million users spend an average $500 per year on Apple products and services. There are then other pockets of “core” Apple users in various countries including China, Japan, the U.K., and Australia.

Based on Apple’s installed base disclosure, we know there are at least 400 million Apple users who use only one Apple device: an iPhone. The actual number could be much higher. Given an iPhone upgrade cycle of four years and an iPhone ASP of approximately $750, this tells us that at least 400 million people are likely spending somewhere around $200 per year.

Accordingly, Apple’s billion users can be broken into the following groupings:

200 million people spending an average of $25 per year (people in the gray market).

620 million people spending an average $260 per year (includes 400M iPhone-only users upgrading every four years).

180 million people spending an average $500 per year (Apple’s core users in the U.S. and a handful of other countries buying a number of Apple products and paying for various services and subscriptions).

Growth Driver

The iPhone has been Apple’s primary vehicle for bringing people into the ecosystem. No other Apple product has come close to the iPhone in this respect. Exhibit 1 includes my estimates for the number of users purchasing their first new iPhone directly from Apple or a third-party retailer. This serves as a rough proxy for the number of people entering Apple’s ecosystem.

Exhibit 1: Number of Users Buying Their First New iPhone

More information and discussion behind how I derived the preceding estimates is available here.

Based on recent iPhone sales trends, there is evidence of fewer users buying their first new iPhone. For example, my expectation is for 52 million people to buy their first new iPhone in 2019. This total is 60% less than the peak number seen in 2016.

After the iPhone, the iPad has been the second-largest driver bringing new users into the Apple ecosystem. However, given that the iPad installed base is a third of the size of the iPhone installed base, the new user totals just don’t compare to those of iPhone.

Putting all of the pieces together, Exhibit 2 includes my estimates for how Apple’s overall ecosystem has grown in terms of the number of users.

Exhibit 2: Number of Apple Users

Slowing New User Growth

There is no question that Apple’s user growth is slowing. Much of this is due to Apple running out of premium smartphone users in key markets like China and India.

Some people are convinced slowing user growth represents a warning sign for Apple. The concern is that Apple will once again look to milk existing users with higher-priced products and services in an effort to offset slowing hardware sales. Much of this fear is based on how lack of new user growth nearly killed Apple in the 1990s. Instead of focusing on new user growth, Apple milked existing Mac users for as much money as possible. The end result was a complicated product line that lacked focus and vision.

In my view, this is an incorrect way of thinking about today’s situation.

Much has changed with Apple over the past 25 years. During the mid-1990s, Apple’s user base was a fraction of the size of today’s user base. Apple had around 25 million users in the mid-1990s. Simply put, Apple’s user base wasn’t large enough to reach sustainability. Instead of focusing on bringing in new users, Apple took the easy route and simply kept selling to existing users. Today, Apple has 40 times the number of users and is bringing in 25 million new users roughly every six months. Apple’s billion users comprise a self-sufficient ecosystem. The company is in a strong position to sell additional devices and services to these billion users without jeopardizing the long-term health of the ecosystem.

New User Plateau

While new user growth is slowing, it’s not a given that Apple will reach some type of user plateau. As Apple continues to move into more personal devices such as wearables, the company’s addressable market will expand, especially in emerging markets. In countries like India and Brazil, products like iPhones, iPads, and Macs may not be the best tools for bringing new users into the ecosystem. Instead, lower-priced wearables may eventually open the doors to tens, if not hundreds, of millions of new Apple users in markets that up to now have been largely out of reach.

Opportunity

Apple is a design company tasked with developing tools capable of improving people’s lives. Such a mission plays a critical role when figuring out how best to judge Apple.

Apple doesn’t think about financial items such as revenue or profit margins when developing products. The same principle applies to new user growth. Jony Ive and the industrial design group don’t sit around a table and come up with products for the purpose of bringing new users into the ecosystem or increasing revenue per user. Such motivation would have manifested itself in a less focused product line over time.

However, Apple does consider and think about how new products may fit within the existing product line. For example, Apple Watch was launched out of the gate as an iPhone accessory. A pair of smart glasses will likely be similarly positioned as an accessory out of the gate as well. These considerations are part of Apple’s long-standing goal of making technology more personal and having new products serve as simpler alternatives to existing products.

The implication found with this product strategy is that one of Apple’s key opportunities going forward is found with developing and then selling new tools to existing Apple users. A feedback loop can then be created as new tools and services drive higher user loyalty and engagement and subsequently even higher tools and services adoption. This will likely manifest itself in higher revenue per user over time as Apple users rely on additional Apple tools in their lives. As Jony has said in the past, financial items like revenue and profit end up being byproducts of a successful product strategy.

This brings us back to the Apple revenue per user calculations from up above.

200 million people spending an average of $25 per year (people in the gray market).

620 million people spending an average $260 per year (includes 400M iPhone-only users upgrading every four years).

180 million people spending an average $500 per year (Apple’s core users in the U.S. and a handful of other countries buying a number of Apple products and paying for various services and subscriptions).

With wearables, Apple is in a good position to drive a portion of the 400 million users who likely only have an iPhone to begin using another Apple device. One way of measuring this opportunity is that if 200 million people spend more like $350 per year versus $260 per year, Apple could see an additional $18 billion of revenue per year. Another opportunity is found with the 200 million users who are part of the Apple ecosystem via the gray market. Assuming Apple can sell additional tools to a portion of those users, Apple would see something in the neighborhood of $12 billion of additional revenue per year (100 million people spend more like $150 per year versus just $25 per year). These are huge numbers that speak to how much room the company has for existing Apple users to become more engaged with the ecosystem. In the mid-1990s Apple simply tried to milk its limited number of users of more money. Apple is now engaged in expanding its users’ tool arsenal while continuing to add new users to the ecosystem.

While Apple will continue to face various risks when it comes to maintaining user loyalty and engagement, especially when it comes to factors outside of its control like economic and geopolitical developments, the big picture is that Apple’s billion users is a game changer. The company has reached a level of ecosystem strength that still hasn’t been fully digested by the marketplace.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.